By Karl Strom, editor

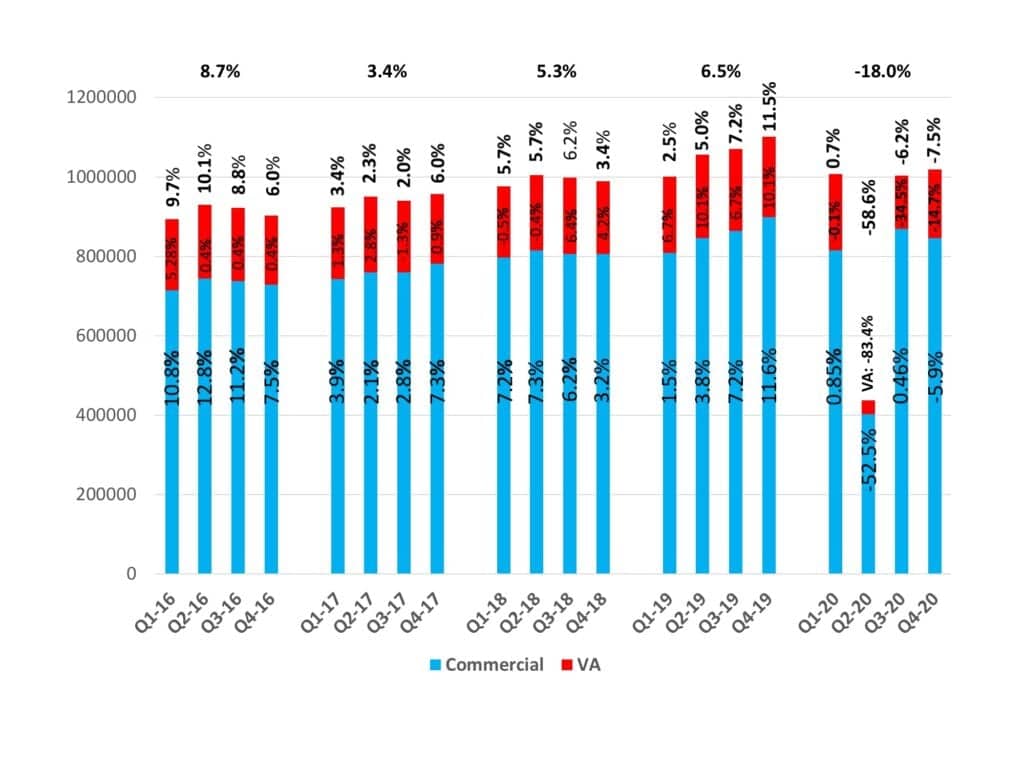

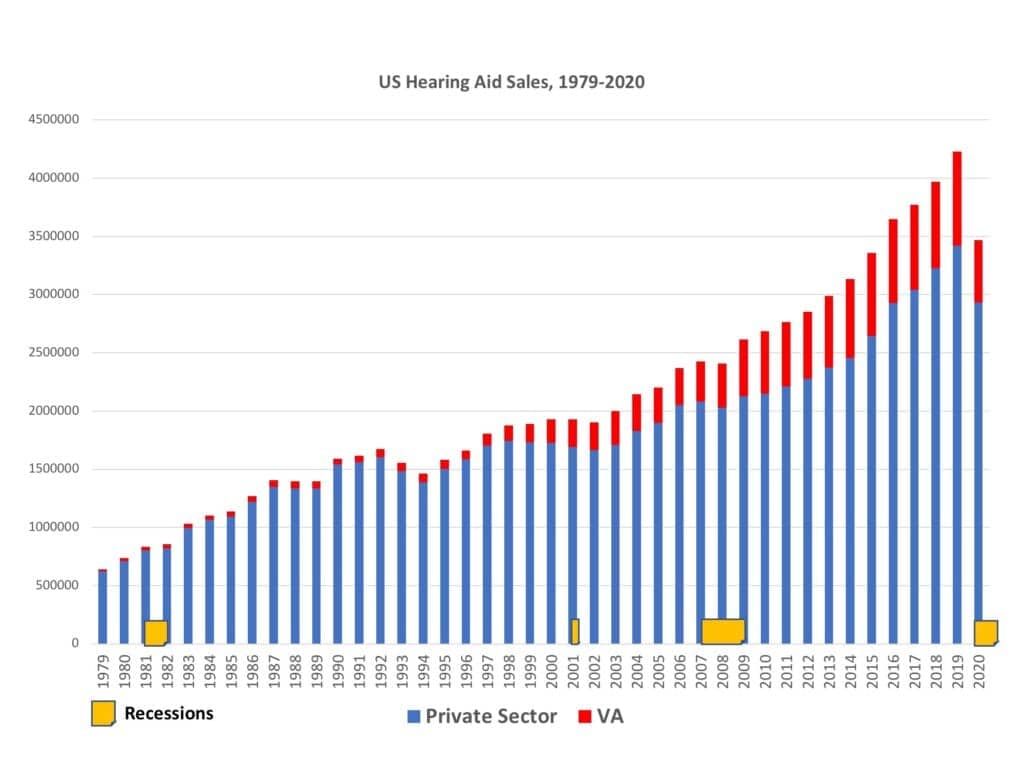

After a promising third quarter, the fourth quarter of 2020 (Q4 2020) was worse than expected for hearing aid dispensing, as regional resurgences of Covid-19 cases and lockdowns depressed overall sales by 7.5%— bringing to close a year that will be easy to identify in all future sales graphs (Figure 1). According to Hearing Industries Association (HIA) statistics, total US net hearing aid sales in 2020 reached 3.47 million units, a decrease of 18.0%, with the private/commercial sector experiencing a decrease of 14.2% and the US Department of Veterans Affairs (VA) a decrease of 34.0%.

In the fourth quarter, commercial unit sales of hearing aids fell by 5.9% compared to Q4 2019. This followed a Q3 rebound which saw commercial sales nominally exceed (0.46% increase) last year’s sales during the same period. Thus, Q3 was viewed as a strong recovery after an extremely distressing second quarter—caused by the initial pandemic lockdowns—which resulted in a 52.5% decrease in commercial unit sales and the near-complete cessation of VA dispensing (-83.4%), for an overall Q2 decrease of 58.6%. Although VA sales were better in Q4, dispensing activity at the VA has been slower to recover, probably due to the VA’s unique patient demographic, priorities for specialty care, and the setup of its facilities.

When looking at Figure 1, the Q2 sales falloff tells the main story of 2020. Hearing Review’s Covid-19 Impact Survey #1, conducted between March 19-24, showed that many practices were shutting their doors, and subsequent unit sales probably fell by about 25% in March, following strong (>10%) January and February sales. April was much worse. The HR Covid-19 Impact Survey #2, conducted from April 9-17, showed that fewer than one-third of private and retail practices were physically seeing patients, and unit sales plunged somewhere in the range of -85%. By May, however, three-quarters (74.8%) of respondents to the Covid-19 Impact Survey #3 said they were physically seeing patients, with an even split between those offices observing regular operational hours (38.2%) and those with scaled back or reduced staffing (36.6%). By June, some practices were seeing a turnaround in sales that continued, in fits and starts, as each region took its turn as being a Covid-19 “hot spot, through the third quarter and through October.

Related article: BIHIMA Releases Q3 2020 Market Data Showing Recovery After Lockdown

The Hearing Review had been rather upbeat about the prospects for hearing aid sales in Q4, predicting in early October that “barring a major escalation in COVID-19 case numbers, massive civil unrest, or some other unforeseen catastrophe” 2020 total unit sales would end up at -16% compared to 2019. Unfortunately, the “second wave” of the pandemic and subsequent lockdowns and/or consumer caution bumped that decrease to -18% (-14% commercial market; -34% VA) for a total of 3.47 million units compared to 4.23 million in 2019.

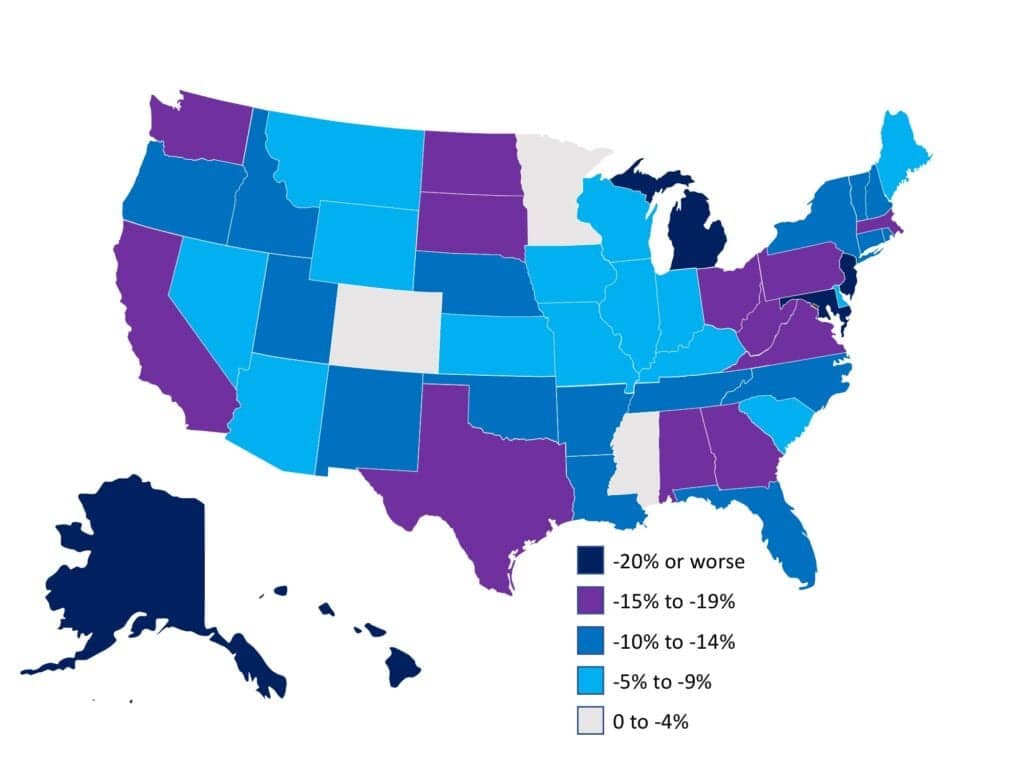

Hearing aid sales by state/region and markets. According to the HIA statistics, no state was spared a downturn in sales during 2020 (Figure 2). Among the worst-hit were Alaska (-26.9% decrease in unit sales), the Mid-Atlantic states of New Jersey (-22.9%) and Pennsylvania (-18.6%), Maryland (-21.1%), Hawaii (-20.5%), Michigan (-20.1%), Virginia (-19.3%) and West Virginia (-18.5%), California (-17.9%), Texas (-17.2%), and Washington state (16.8%). In general, the Midwest and Mountain states saw the least-negative impact in hearing aid sales, with Minnesota (-1.8%) and Colorado (-2.9%), as well as Alabama (-1.0%), getting by mostly unscathed in terms unit sales losses.

Medicaid accounted for 196,000 units in 2020, or 5.6% of all the hearing aids dispensed in the US (up slightly from 5.4% in 2019), while the VA dispensed 533,000 units, or 15.4% of all US hearing aids (down sharply from 19.1% in 2019).

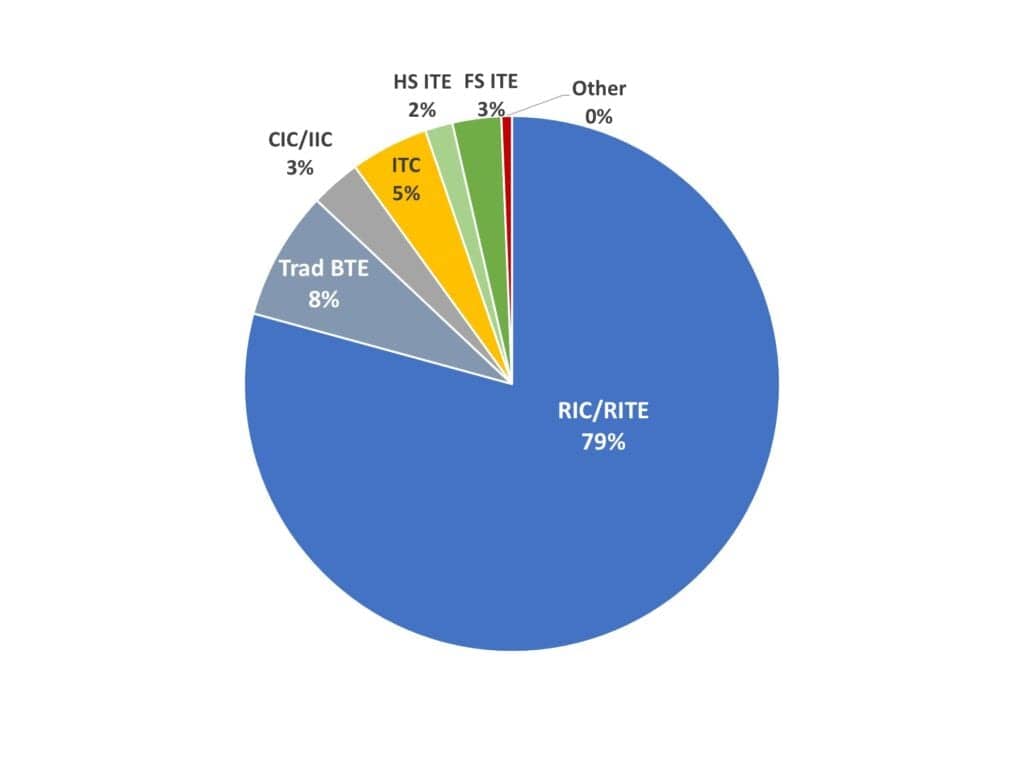

Hearing aid styles in 2020. Hearing aid styles changed very little in 2020 from the previous year (Figure 3). For the entire market (private + VA), receiver-in-the-canal (RIC) and receiver-in-the-ear (RITE) type hearing aids accounted for almost 4-in-5 (79%) of all the hearing aids dispensed in the United States in 2020, up only nominally from 2019 (78%). Traditional BTEs made up 8% of the hearing aids dispensed, a 2 percentage point decrease from the year before. So, taken together, BTEs comprise 87% of the market while ITEs comprise only 13%: in-the-canal (ITC) hearing aids made up 5%, full-shell and half-shell ITEs (FS/HS ITE) accounted for 5%, and completely-in-the-canal and invisible-in-the-canal (CIC/IIC) aids made up 3% of the total market.

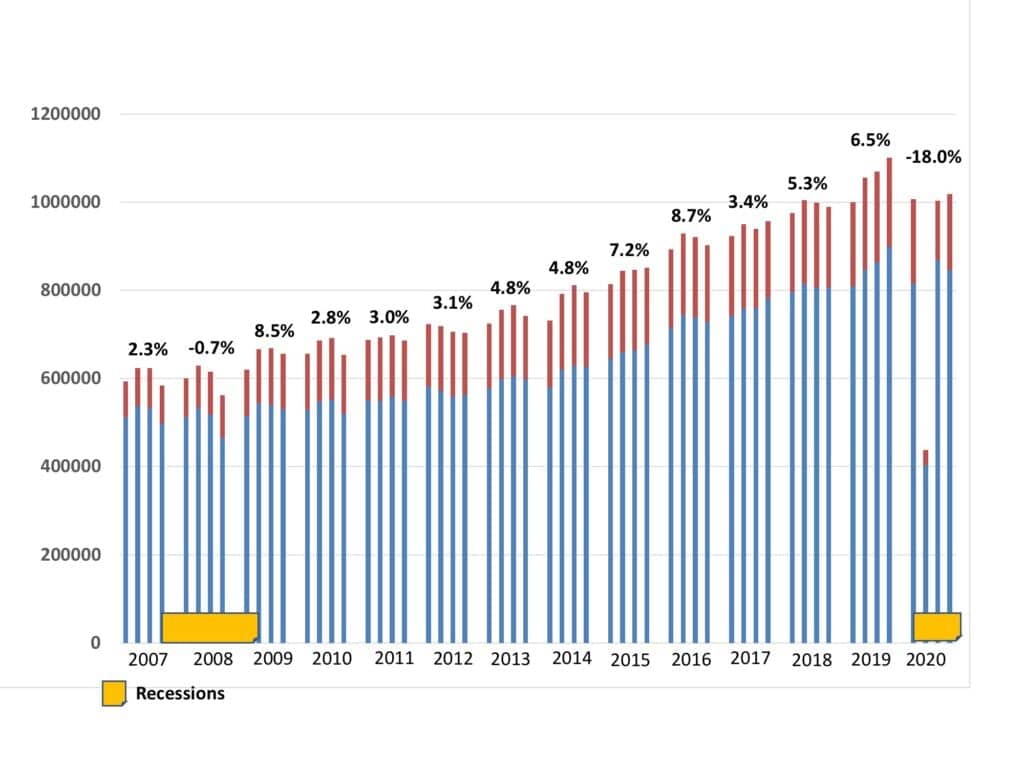

Moving forward to “post-pandemic.” Looking ahead to this year, most industry market analysts and experts are predicting a healthy rebound in hearing aid sales in 2021—although it largely depends on how quickly the vaccine can be rolled out (particularly to seniors) and the economy’s recovery. However, if Q3 2020 can be seen as a “false start” in the sales rebound, it seems likely that dispensing offices will prosper from the gradual end of the pandemic and pent-up demand, hopefully beginning in the first quarter. Figure 4 shows that hearing aid unit sales growth has been strong, averaging 5.3% annually from the Great Recession in 2008 to last year.

An even longer view (Figure 5) suggests that—even with the disruption caused by third-party payers, Big Box, and the looming new OTC class of amplification devices—there is plenty to be excited about for hearing care stakeholders. The market is benefiting from an aging population, increased awareness about better hearing and its potential effects on cognition and general health, and the new technologies like cellphone compatibility, LE Bluetooth streaming, remote programming, AI systems, inertial sensors/fitness tracking, rechargeability, etc.

Lessons learned from 2020? Although I have previously presented evidence about how the hearing industry is more resistant to recessions than most other industries (see Figure 4), it turns out that a downside may be our industry is uniquely vulnerable to pandemics and probably anything else that would dissuade older adults from venturing from their homes (eg, extended weather events, etc). April sales (estimated at -85%) fell to nearly the same low levels seen only by the most exposed markets like the retail clothing and accessories industry. In our industry, due to the average age of first-time hearing aid purchases (age 65+)—the people being hardest-hit and most at-risk by Covid-19—combined with the initial confusion and fear surrounding Covid-19 transmission, the pandemic benefited only the makers of online amplification devices. In conversations with experts involved in that market segment, PSAP and online hearing aid manufacturers probably saw unit gains in the 15-20% range. One prime example of this expansion was Eargo, which expected 97% net revenue growth in 2020 after its IPO raised $141 million in October.

Given all this, the pandemic-induced overall 18% unit decline in hearing aid sales (-14% for the commercial market) actually showed a fairly amazing resiliency for US hearing healthcare practices. Enhanced infection control, teleaudiology and remote evaluations/fittings, and adherence to best practices were all given their moment to shine and demonstrate their importance to hearing care practices—now and in the future. 2020 was also the year for careful practice management with an astute eye on your P&L and cash flow.

Perhaps the biggest lesson learned from 2020 is not to take anything for granted—in our industry or elsewhere. However, barring a collapse in the pandemic response, market analysts contend the hearing industry is poised for exceptional growth, possibly beginning in the first quarter.

Karl Strom is editor in chief of The Hearing Review and has been reporting on hearing healthcare issues for over 25 years.

Where are the stats on INTERNET sales? Sales tax applies per State? Lack of licensure or is there Nationwide licensure required?

Ethics?

Hi Sandra. I know of no statistics on internet sales of hearing aids. Sorry.

Hi Sandra, As a consumer who is decades younger than the average age of your market I also have concerns for the Ethical practices-but of in person hearing aide sales – due to my own personal experiences. I take my experiences as very valuable research data. I am educating myself as a consumer and I am very open to online sales in the future. Perhaps unlike the retired segment, as a working individual, I can not be tethered to the audiologist waiting room. People my age are consumers and will be customers for *decades, so I think the industry might do well to think about how the industry can innovate the simple things (not talking about AI here – talking about the simple things). Since I am a hearing impaired RN, I can assure you that Covid did flip all healthcare settings financials (as well as most all other industries)—survival now might require agility. Stay safe!