Updated March 26, 2020

Link to: Survey #2 (April 9-17)

A chronicle of the reaction to the COVID-19 pandemic in hearing healthcare

By Karl Strom, editor

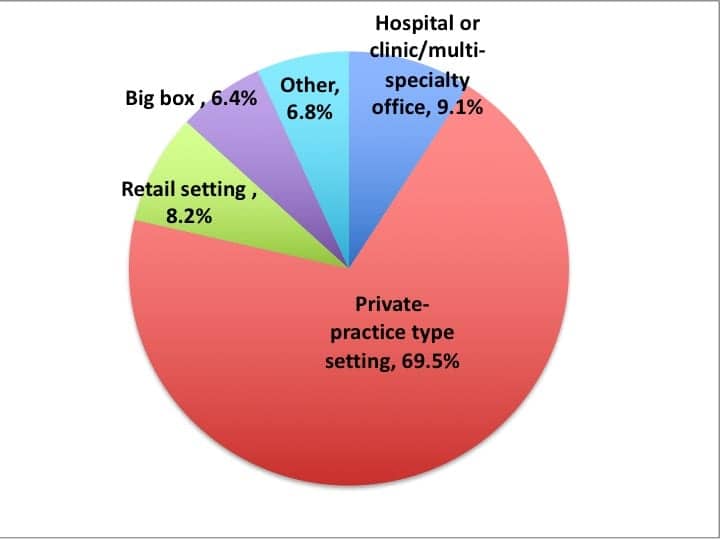

Because of the unprecedented events related to the Covid-19 (SARS-CoV-2) pandemic, Hearing Review initiated an informal online-only survey starting on Wednesday afternoon, March 19, and concluding Tuesday evening, March 24. The survey was available to hearing care professionals (HCPs) via the Hearing Review website, with several posts linking to it primarily on Facebook and LinkedIn. As with any survey, the results of this one come with several important caveats, which include a relatively small sample size (n=206-220) of respondents who were overwhelmingly involved in a private practice (>75%), and who were readers of HR online offerings and/or following or exposed to our social media channels.

Although this report does not capture the responses per day, I have included a couple examples of how the answers changed during the 6 day survey; business conditions worsened appreciably even over the course of the survey, particularly as government agencies and professional organizations recommended the closure of “non-essential” businesses (a hotly debated definition). It should also be acknowledged that, because various cities and regions of the US and Canada (and the world) have been impacted differently by Covid-19—and the following statistics do not account for geography—this survey should be looked at only as a general snapshot of how Covid-19 is affecting the field. Hopefully, it will add some context to your own situation, and allow dispensing professionals and industry experts to better appreciate this dynamic and quickly evolving situation.

Figure 1 shows that survey respondents were typically professionals who worked in a US private practice type setting (69.5%) or retail setting (8.2%). Hospitals or clinics and multi-specialty offices (9.1%), as well as big box retailers (6.4%) and “others” (including ENT offices and university facilities) rounded out the remaining respondents. All respondents dispensed hearing aids, and generally speaking, their demographics were fairly reflective of HR’s magazine and online readership based on our circulation statistics.

SURVEY FINDINGS

Changes in work schedules, appointments, and operations

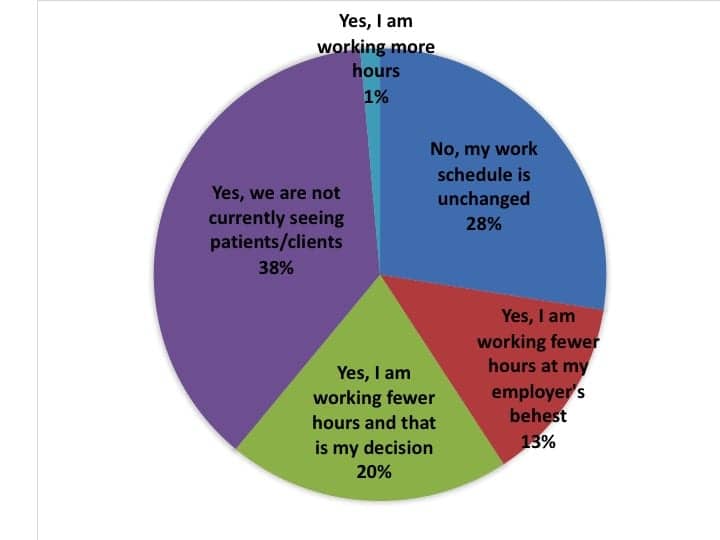

When asked how COVID-19 had changed their work schedule (Figure 2), respondents were roughly split into three segments: less than a third (28%) said their work schedule had not changed; one-third (33%) said they were working fewer hours, either at their own discretion (20%) or at the behest of their employers (13%); and more than one-third (38%) said they were currently no longer seeing patients/clients. This latter figure continued(s) to slide toward “working fewer hours” and particularly “not currently seeing patients/clients” as time passed. It was also evident that a number of HCPs—while not necessarily seeing patients—are still manning their offices/practices. It has been noted in personal correspondence that some HCPs are using this time to update their knowledge and capabilities relative to teleaudiology, office management systems (OMS), and clinical knowledge/skills, while also seeing those patients who are in need of emergency care or helping them solve problems without necessarily coming into physical contact with them. So, while their actual work schedule may not have changed drastically in some cases, what they’re doing at work (ie, not seeing patients) may have.

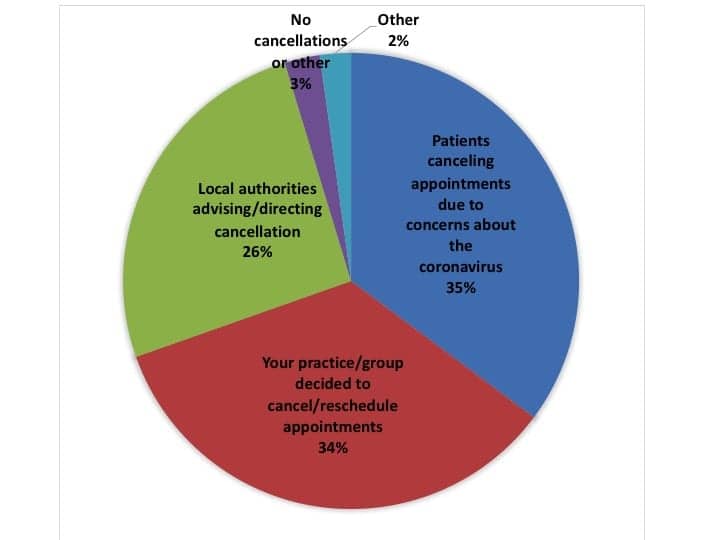

Appointment cancellations and rescheduling. When asked about the primary reason for appointment cancellations (Figure 3), patients phoning into the office to cancel due to cornonavirus concerns (35%) and the practice/group deciding to cancel the appointments (34%) were the most common reasons, while local authorities, government advisories, and “other factors” constituted 26% of cancellations. Of course, this latter segment continues to increase as more states enforce measures such as “shelter in place” and restricting citizen’s activities.

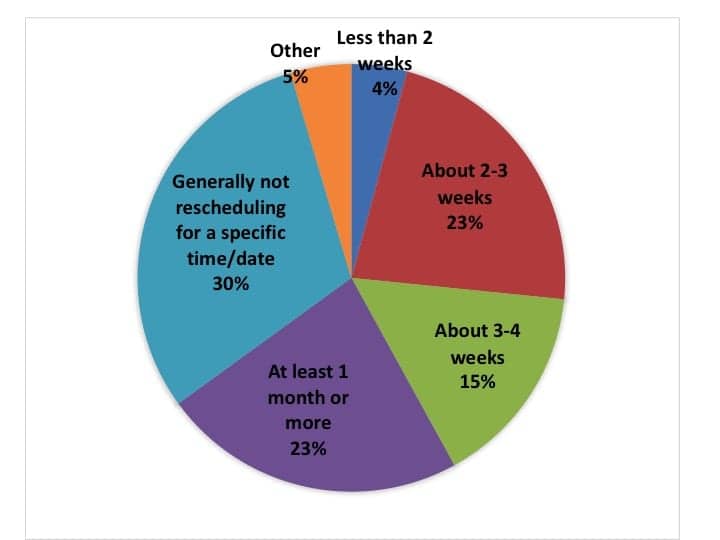

Similarly, another question where the answers varied depending on when the HCP took the survey was how far out cancelled appointments are being rescheduled (Figure 4). In the first 3-4 days of this survey, about half said they were rescheduling patients to be seen in 2-4 weeks. However, by the conclusion of the survey, the majority of HCPs reported rescheduling at least 1 month or more (23%) or “generally not rescheduling for a specific time or date” (30%). A total of 23% were rescheduling “about 2-3 weeks” or “about 3-4 weeks” (15%) into the future. Only 4% said they were trying to reschedule appointments in “less than 2 weeks” time with most of these responses being received early in the survey.

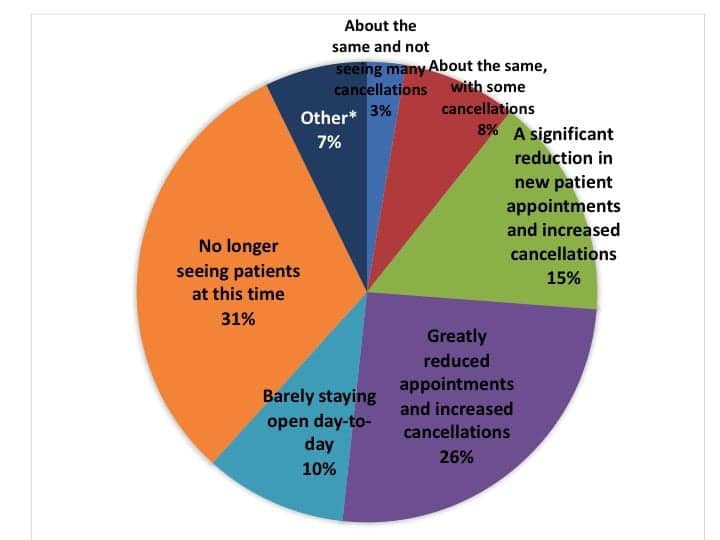

Patient appointment calendars get progressively emptier. Figure 5a shows results for the question, “What best describes your appointment schedule/calendar today?” The answers to this question also changed markedly with time, particularly from the start of the survey (Thursday, March 19) to Saturday (March 22). In total, about two-thirds of respondents reported “greatly reduced appointments and increased cancellations” (26%), “barely staying open day-to-day” (10%), or “no longer seeing patients at this time” (31%). Note that many or most of these latter practices were still providing essential services, and the 7% figure reported as “Other” was largely due to explanations that included “providing telehealth,” “taking care of repairs,” etc—so the actual statistic for HCPs who are no longer seeing patients is probably closer to 38% (31%+7%). About 1-in-10 HCPs reported their practice’s patient calendar was mostly unchanged, with 3% “not seeing many cancellations” and 8% only seeing “some cancellations” —although, again, many of these responses were registered early in the survey.

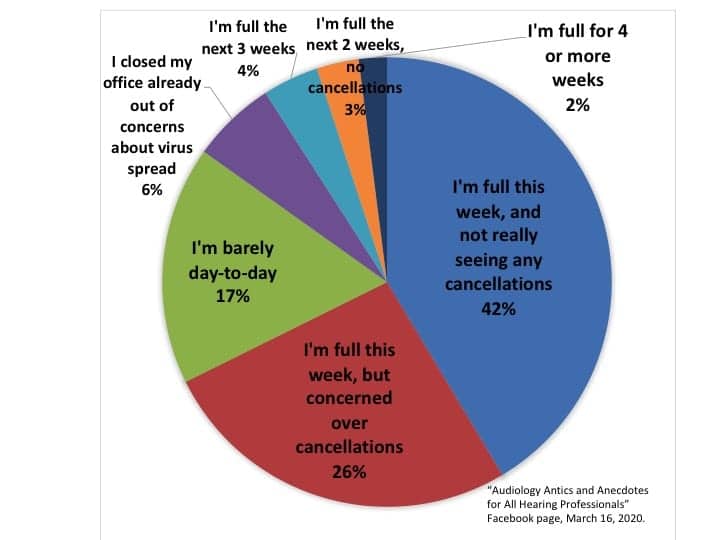

Figure 5b shows answers to a similar online question posed by audiologist Scot Frink, AuD, on the “Audiology Antics and Anecdotes” Facebook page. The data shown was collected on Monday, March 16. Even given the differences in the two surveys’ questions, audiences, sample size, etc, it reflects just how fast the situation eroded. In Dr Frink’s poll, only about a quarter of the respondents were experiencing trouble filling their appointment calendars, with only 6% closed due to “concerns about virus spread”—although another quarter had full calendars but were concerned about cancellations.

By mid-week (March 18), the CDC was warning people ages 60+ not to engage in non-essential medical care, and state and local governments were closing schools, restaurants, and generally warning citizens to begin “social distancing.” Given that the average age of a first-time hearing aid user is just under age 70, this posed a huge problem for dispensing practices. On Sunday (March 22), AAA President Catherine Palmer posted a video recommending audiologists temporarily close their practices, except for essential care and/or services that could be conducted via telecare or safe physical distancing.

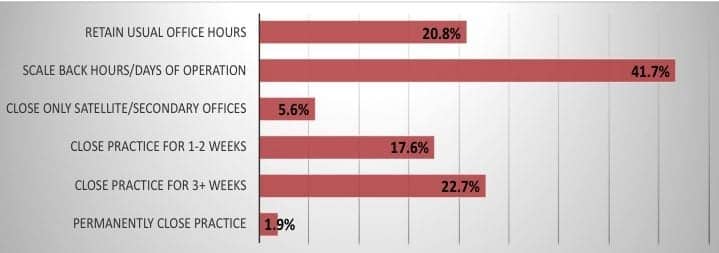

Adjusting the workday/week. Likewise, when HCPs were asked “What best describes your plans for the business during the next month (check all that apply)?” their answers also progressively slid toward scaled-back operations or practice closure as time progressed. Figure 6a shows that the most-common tactic was to scale back hours of operation (42%), and about one-fifth (20.8%) planned to maintain usual office hours. Similar numbers of HCPs 18% planned to close for 1-2 weeks, and a slightly higher percentage (23%) planned to close for 3 weeks or more. Three respondents indicated their offices would be permanently closing.

Figure 6b. Last Week vs This Week: What best describes your plans for the business during the next month (check all that apply).

Figure 6b looks at this same question by separating responses on Thursday-Sunday (March 19-22, in blue) from responses made on Monday-Tuesday of this week (March 23-24, in red). It can be seen that, after last weekend, far more HCPs realized they probably will be either scaling back their office hours or closing for 3+ weeks instead of the more favorable business options.

Hearing Aid Sales and Revenues

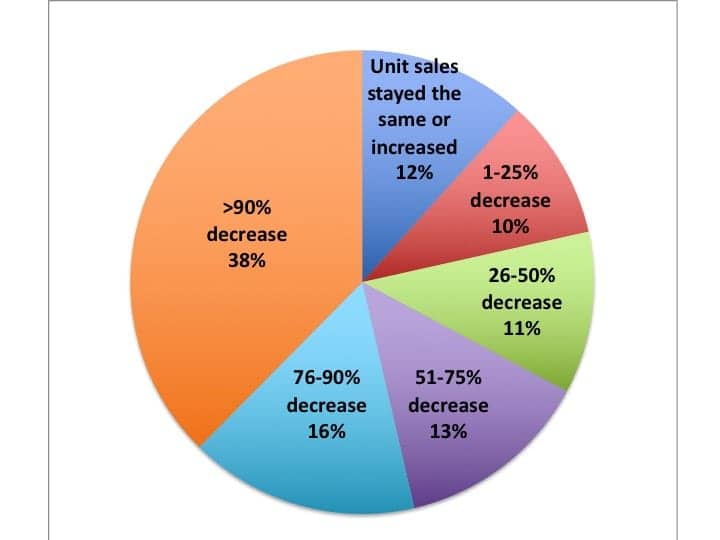

Hearing aid sales in the last week. Figure 7 shows that over two-thirds (67%) of HCPs indicated they had seen their hearing aid unit volume sales cut in at least half due to Covid-19, with nearly 2-in-5 (38%) of HCPs saying their practices saw unit sales plummet by over 90%—which is logical in light of the fact that about 31-38% of practices reported no longer seeing patients except for emergency/essential cases and services not requiring physical interaction (see discussion about Figures 5a-b).

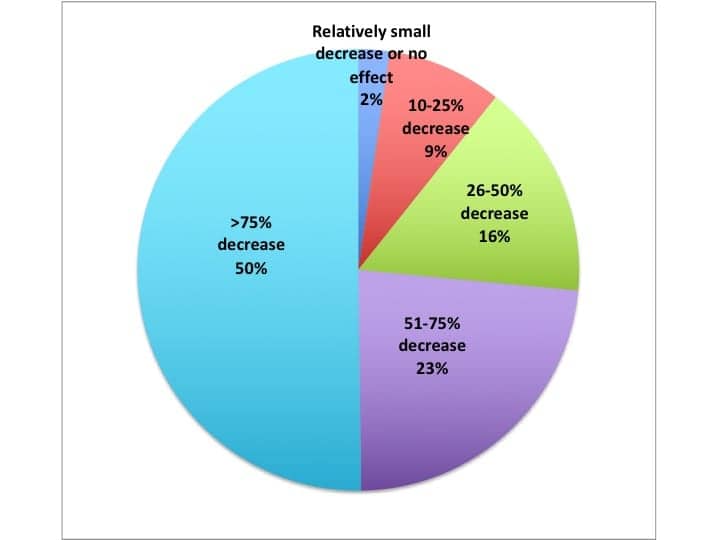

Changes in gross revenue. When asked to predict the effect of the coronavirus pandemic on gross revenues during the next month, a full half (50%) of respondents said they expect revenues to fall by over 75%, while another one-quarter (23%) expected revenues to decrease by 51-75% (Figure 8). A total of 16% of respondents predicted their revenues to fall by 26-50%, and 9% by 10-25%. Only 2.4% believed their revenues would be relatively unaffected or fall by less than 10%.

Hearing Care Practice Survival Tactics for Covid-19

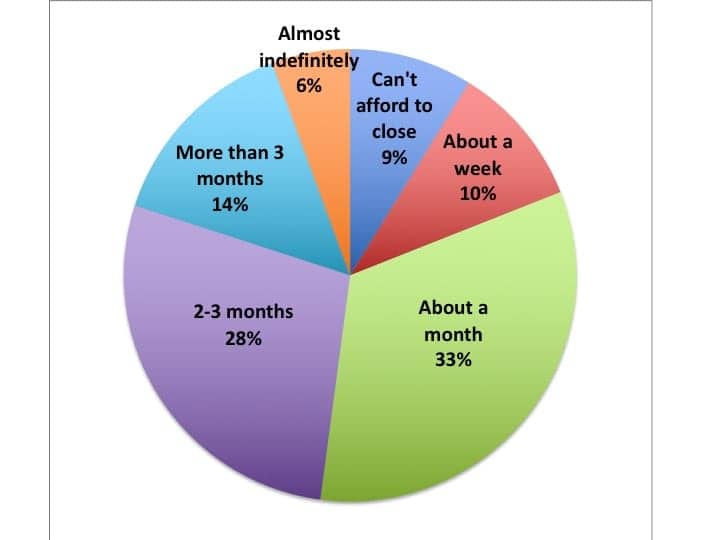

So, if hearing care practices are closing down or not seeing patients for public safety reasons or because of mass cancellations, how long can a practice remain closed before it experiences severe financial stress? Figure 9 shows answers to this question, with responses suggesting a typical practice would run into trouble within about a month’s time. This is in line with a JP Morgan analysis Brian Taylor, AuD, quoted in his recent article about cash flow in a practice that showed “only about half of all small businesses hold a cash buffer large enough to support 27 days of their typical outflows.” In this HR survey, about 3-in-5 practices said they could stay closed for “about a month” (33%) or for “2-3 months” (28%). About 1-in-5 practices were in much better shape, with respondents saying they could close for “more than 3 months” (14%) or “almost indefinitely” (6%). However, another 1-in-5 practices were in much worse financial shape, saying they either “can’t afford to close” (9%) or would experience a threatening financial situation in “about a week” (10%).

Teleaudiology to the rescue? One logical tool for helping a practice through a prolonged shutdown like the one we may be facing is teleaudiology or eAudiology. Hearing Review has published extensively about implementing telecare over the past decade, and most major hearing aid manufacturers and special equipment companies now offer teleaudiology components in their systems’ software (and blended models like Lively and Blamey-Saunders are also emerging). More is coming, and Covid-19 is likely to spur the teleaudiology movement. In fact, last week the OMS provider Sycle.net released a teleaudiology or virtual visit component to its software with appointment calendar integration. However, outside of VA centers, industry experts estimate that, while possibly 25% of dispensing practices have downloaded teleaudiology system software, probably fewer than 5-10% have actually used it for patient care. We may be seeing a renaissance in hearing telecare.

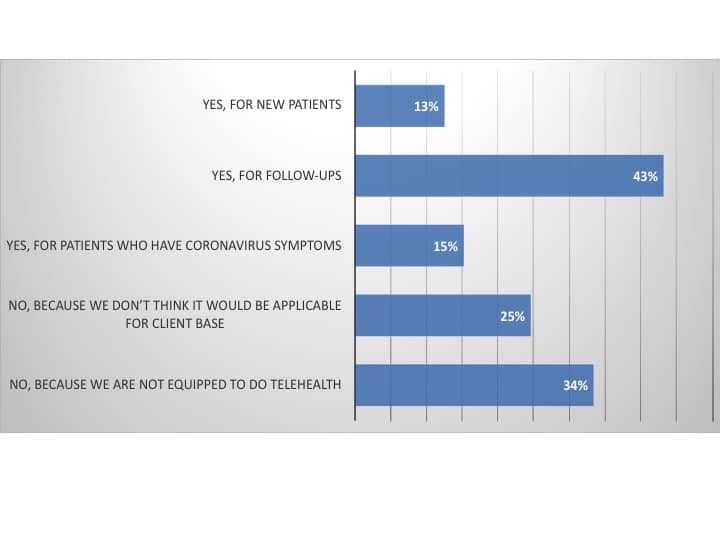

Figure 10 shows answers to the question, “Is teleaudiology/telehealth part of your strategy for dealing with the coronavirus (check all that apply)?” A total of 43% of respondents said they will use teleaudiology for “follow-ups” (eg, reprogramming/adjustments, counseling, etc), while 13% said they planned to use it with new patients and 15% said they plan to use it for those patients who have contracted the coronavirus. Slightly more than one-third (34%) reported they were “not equipped to do teleaudiology” and one-quarter (25%) said they didn’t think “it would be applicable for [their] client base.”

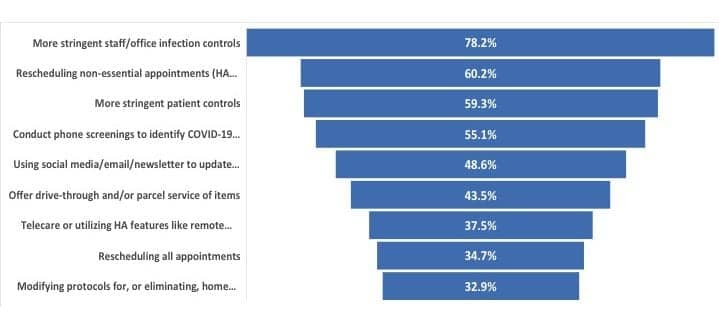

Not surprisingly, when asked “What are you doing differently in response to the coronavirus outbreak (check all that apply)?” (Figure 11), most survey respondents said they were practicing “more stringent staff/office infection controls” (78%), “rescheduling non-essential appointments” like hearing aid checks, etc (60%), and observing “more stringent patient controls” like the avoidance of physical contact and having them wash/sanitize their hands, etc (59%), and conducting “phone screenings to identify Covid-19 symptoms” in patients (55%). Nearly half of respondents were using social media, email, or newsletters to update their patient base (49%) or offering drive-through and/or parcel delivery for services like hearing aid repairs, batteries, etc (44%) to further minimize patient contact. Over one-third of practices reported the use of telecare or the use of remote programmable/adjustment features in hearing aid software (38%); rescheduling all appointments (35%); and the modification or elimination of home and off-site visit protocols (33%).

Media and Information Sources

At the behest of the publishers in the Medqor group of trade magazines, to which Hearing Review belongs, we also asked a couple questions about HCP’s media habits and information gathering during the Covid-19 crisis. In response to a question about how often HCPs seek out information related to Covid-19, almost three-quarters indicated they searched out news either 2 to 5 times per day (47%) or over 5 times per day (27%). Smaller percentages indicated looking for this type of news once per day (25%) or less than once per day (1%).

When asked what their “go-to industry news sources” were for the pandemic crisis, the websites, newsletters, and emails of professional organizations were the top pick (77%). Hearing Review and its website/newsletters/social media came in second at 59% (although it should be noted this is necessarily biased due to this poll of our audience/followers), followed by “social media posts and pages” (49%), “manufacturers emails and blogs” (45%), “colleagues emails and conversations” (46%), “other journals/websites/newsletters” (35%), and “hearing related blogs” (14%).

Discussion

The novel coronavirus (COVID-19) is already having a significant impact on the global and national economy. From an economic perspective, it’s difficult to construct a much more challenging scenario for a hearing healthcare practice. Within about a week’s time, we moved from a worrisome problem to a full-blown national crisis, so it’s extremely difficult to prepare or make clinical/business contingencies. It is apparent Covid-19 is most dangerous for the specific demographic that comprises the majority HCP’s patients— people over age 60, and particularly those with co-morbidities including lung and heart diseases, and diabetes, which are all associated with hearing loss.

Some of the key findings from this survey include:

- About 31-38% of the respondents in the survey were no longer seeing patients (Figures 3 and 5a), and about (42%) planned to scale back their hours of operation, while a similar percentage (40%) planned to close their practices for 1-3+ weeks—although many/most plan on providing services to patients in special cases or for activities that do not require physical interaction (Figure 6a).

- The majority of hearing healthcare practices (54%) have seen hearing aid unit sales decrease by more than 75% in the past week (Figure 7), and most predict they will see more than a 75% decrease in gross revenues during the next month (Figure 8).

- The survey suggests the average dispensing office can stay closed for just over a month before experiencing severe/threatening financial problems—although 10% of HCPs say they can stay closed for only a week, and 9% say they can’t afford to close at all (Figure 9).

- Although teleaudiology/telehealth offers great promise as a tool during the Covid-19 outbreak, less than half of HCPs currently consider it an important part of their strategy for dealing with the coronavirus crisis (Figure 10), and most are currently not equipped to provide teleaudiology services (34%) or they believe it wouldn’t be applicable for their client base (25%).

Governments are now rushing to help businesses survive the duration of the Covid-19 crisis (with estimates ranging anywhere from 3-18 months). In the United States, the Small Business Administration is offering low-interest federal disaster loans for working capital to small businesses suffering substantial economic injury as a result of COVID-19, and it is almost certain that other financial options and easements will emerge from state and local governments, as well as the finance and corporate/manufacturing sectors.

The impact of the Covid-19 virus was swift and it caught our country and industry off-guard. The evidence suggests that on Monday, March 16, HCPs were starting to worry about patient cancellations; by Friday, March 20, they were seeing their calendars empty and bracing themselves for a week or two of closing; by Tuesday, March 24 of this week (the conclusion of this survey) almost one-quarter (23%) of HCPs were planning to close their offices for 3 weeks or more. We can only hope this crisis leaves as fast as it came.

Acknowledgements

Hearing Review thanks those hearing care professionals who took the time to complete this survey and share their information with their colleagues. This report references a timely online poll by audiologist Scot Frink on the Facebook page “Audiology Antics and Anecdotes,” and Dr Frink’s polls were the inspiration for at least two of this survey’s questions. Additionally, HR thanks industry friends Abram Bailey at HearingTracker.com, Kevin Liebe at HearingHealthMatters.com (HHTM), and Paul Dybala at AudiologyDesign for their help in the online distribution of the survey via shares on LinkedIn and elsewhere.

About the author: Karl Strom is editor-in-chief of The Hearing Review and has been reporting on hearing healthcare issues for over 25 years.

Image: © Yakobchuk | Dreamstime.com

Looks like a very hard hit to the Hearing Healthcare Industry. Very sad to see.

Would be good to see a snapshot like this on a weekly basis. Seems like something that HIA might want to do.

Thanks Brent. I may initiate another one next week.

We just posted the questions for Survey #2. Please take it if you’re an audiologist or hearing aid dispensing professional. You can find it here.

Great article. Very informative. Would be interested to see how some of these numbers vary across regions or States. Thanks for putting this together on such short notice. Stay well. Barry Freeman

Thanks Barry. I’m astounded at how FAST the situation changed just during the course of the survey. I’ve never conducted a survey before where the answers slid so fast due to the changing conditions. In fact, the survey is less than a week old, and several of the answers are more-or-less outdated now. But at the very least, it’s representative of a slice in time. I hope you and your family are doing well. Take care.