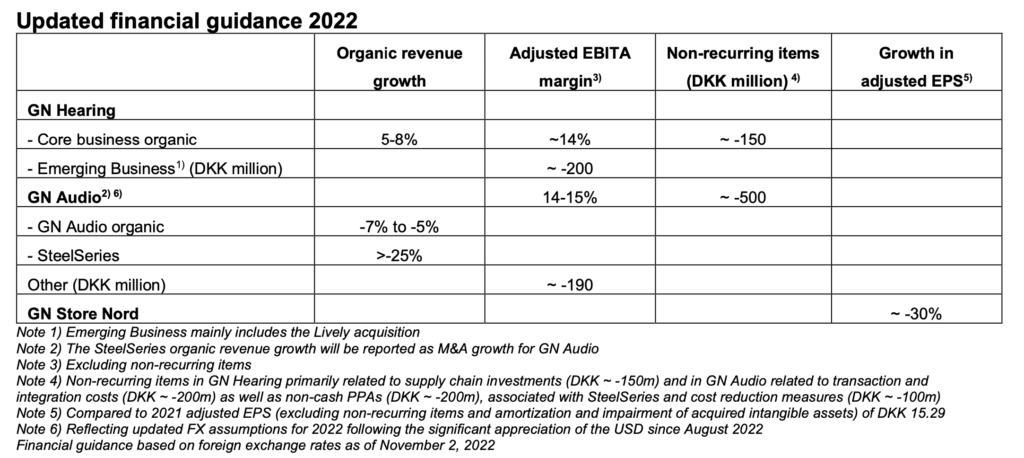

GN Store Nord Audio announced that the financial guidance for 2022 has been revised to reflect the impact of the worsened macroeconomic environment, lower consumer sentiment, and general higher uncertainty which impacts the markets in which GN operates:

- A worsening of the consumer markets across GN Audio with an updated expectation that these markets will decline ~30% for 2022;

- Although the company is observing solid demand in the Enterprise market, it now expects lower than previously anticipated market growth in Q4.

Guidance revision

- GN Audio organic revenue growth guidance is revised from “0-5%” to now “-7% to -5%.”

- Reflecting the lower-than-expected revenue development and the further appreciating USD,GN Audio’s adj. EBITA margin guidance is revised from “17-18%” to now “14-15%.”

- As a consequence of the revised financial guidance for GN Audio, GN Store Nord revises the financial guidance on growth in adj. EPS from between -10% to 0% to now “around -30%.”

- Acknowledging the current sentiment related to a potential recession, GN Audio is taking “proactive and significant actions to reduce the cost base and defend the agility of the company.” For this purpose, guidance for non-recurring items is increased by DKK -100 million (USD -$13 million) relating to Q4 initiatives taking the 2022 non-recurring items from around DKK -400 million (USD -$52 million) to around DKK -500 million (USD -$66 million).

• All other guidance parameters are confirmed

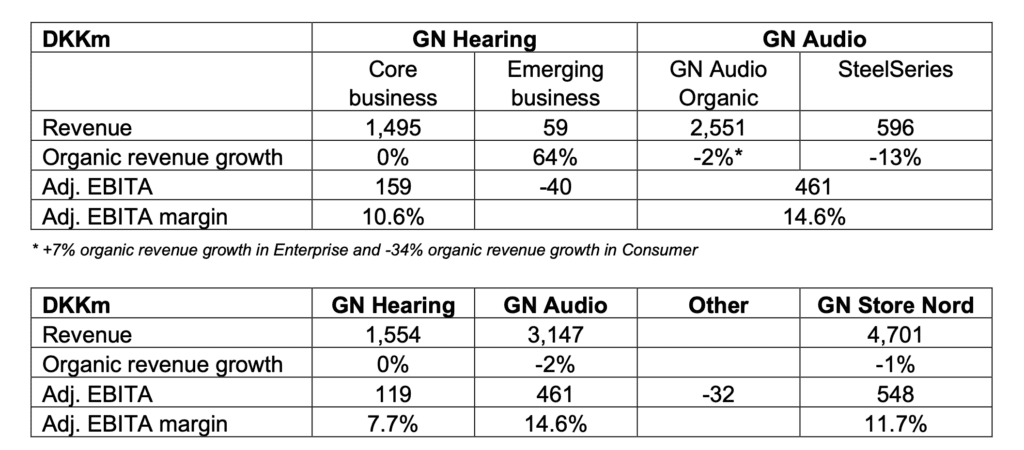

Pre-release of preliminary key figures for Q3 2022:

- 0% organic revenue growth in GN Hearing in soft market conditions. Strong initial sales data from the launch of ReSound OMNIA boding well for strong performance and significant market share gains in Q4 2022, according to the company.

- GN Hearing adj. EBITA margin of 10.6% in the Core business impacted by higher freight and material costs and investments in launch activities.

- -2% organic growth in GN Audio Organic driven by solid organic revenue growth in Enterprise of 7%, but offset by -34% organic revenue growth in the Consumer business.

- Strong sequential improvement in SteelSeries leading to -13% organic revenue growth.

- GN Audio adj. EBITA margin of 14.6%, reflecting investments in growth opportunities, higher freight and material costs, the development in FX, and the consolidation of SteelSeries.

GN Store Nord will, as previously communicated, release its interim Q3 2022 report on November 11, 2022, with further details on the performance in Q3 2022 and will host a teleconference for investors and analysts on the same day.

Primary risk factors in relation to the financial guidance

Due to the COVID-19 pandemic, the global supply situation and the macroeconomic environment – which impacts GN in many ways – it must be stressed that the basic assumptions behind the guidance remain more uncertain than normal, the company says. The situation is impacting GN’s operational performance, predictability, and visibility across markets, channels, and supply chain, according to the company.

Source: GN Store Nord Audio

Images: GN Store Nord Audio