Staff Standpoint | May 2020 Hearing Review

By Karl Strom, editor

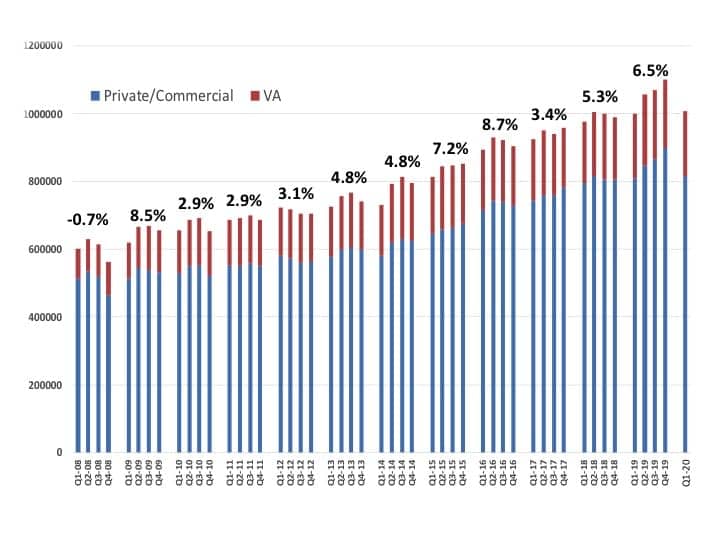

Hearing aid sales appeared to be humming along nicely in January and February 2020. And then we all know what happened. In the first weeks of March, the Centers for Disease Control (CDC) issued more urgent warnings about Covid-19, eventually leading to “shelter in place” orders for most states, school closings, convention cancellations, social distancing, etc—what economists are now calling “The Great Lockdown.” At that point, hearing aid sales basically dropped off the table. The resulting first-quarter (Q1 2020) US net hearing aid unit sales were an overall gain of 0.7% over the same period last year, with private sector sales increasing by 0.85% and dispensing activity for the Department of Veterans Affairs (VA) decreasing by -0.1% (Figure 1), according to statistics generated by the Hearing Industries Association (HIA), Washington, DC.

However, the upcoming Q2 2020 (April-June) sales figures will forever serve as a warning to the hearing healthcare field about the havoc a pandemic can wreak—particularly one that is most dangerous to seniors and/or those at-risk populations such as people with diabetes and heart disease (two comorbidities associated with hearing loss). The good news is that, unless something unexpected happens, April should be our industry’s low-point.

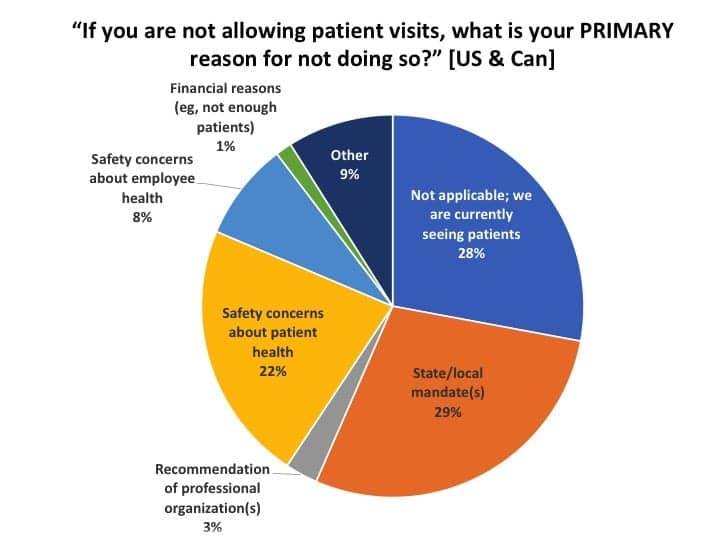

To review, on March 18, the CDC warned people ages 60+ not to engage in non-essential medical care, and by that time state and local governments were already closing schools, restaurants, and warning citizens to begin “social distancing.” On March 22, American Academy of Audiology (AAA) President Catherine Palmer posted a video recommending audiologists temporarily close their practices, except for essential care and/or services that could be conducted via telecare or safe physical distancing. Not surprisingly, Hearing Review’s Covid-19 Impact Survey #1, conducted between March 19-24, produced a wide range of responses from hearing care professionals (HCPs) as the situation rapidly deteriorated. Essentially, the first survey shows that, by the weekend of March 21-22, practice owners had realized they were facing dire business conditions. In the subsequent HR Covid-19 Impact Survey #2, which ran from April 9-17, responses from HCPs suggested a mostly closed-for-business status during that time: fewer than one-third of private and retail practices were physically seeing patients, and almost two-thirds of all dispensing offices predicted they would experience a 90% or greater decrease in gross revenues during April. Thus, although several market analysts predicted hearing aid sales decreases of 60-65% in April, the survey seems to suggest a decrease in the neighborhood of 80-85%.

However, Survey #2 also suggested that May will be the start of the recovery. It shows that close to one-third of US and Canada dispensing offices had closed primarily due to government mandates, many of which were set for easing in the beginning of May (see News on p 7). Two thirds (66%) of these same respondents indicated they planned to observe full-time or scaled-back operations in May (even given the fact that “full-time” was a write-in-only option due to it being accidentally omitted from our questionnaire), and another 7% planned to close for only 1-2 weeks in May.

Of course, the VA is another important part of this puzzle, constituting about one-fifth of all US hearing aid units dispensed. Although veterans have been discouraged from making appointments until at least mid-May, this will also hopefully improve as we move toward June and July.

It’s also important to recognize that, even though many practices are not currently seeing many patients, important work is still being done in them to prepare for their future growth. Survey #2 shows that the vast majority of dispensing offices have been using their downtime for cleaning and renovation, updating patient files and optimizing OMS data, improving telecare capabilities, contacting patients, and more. As Dan Quall says in our recent interview with him, “Remember all the things you said you’d do for your business if you just had the time? Well, now’s that time!” Indeed, many are seeking to get a head-start so they can race out of the gates and fill their appointment books as soon as safely possible.

Another cause for optimism was Congress’ recent approval for a second round of funding for the Payroll Protection Program (PPP) after the first round was quickly depleted, leaving many practices in limbo. Survey #2 showed that 78% of US private-practice and retail offices had either applied or were interested in receiving a PPP loan, and another 43% had either applied or planned to apply for the Economic Injury Disaster Loan (EIDL) emergency advance. The same survey showed that more than one-third (35%) of these HCPs considered the loans as “essential for survival.” Round 2 of these loans is also expected to go very fast, if not almost instantly. But the ultimate result has been that a large number of practices greatly benefited—and some were saved—by these two government loan programs.

Of course, the future depends on how successful we’ve been at “flattening the curve,” as well as the subsequent government and individual states’ assessments of risk, response, and advisories or mandates. We’ll then also have to cope with the economic fallout of the coronavirus; however, as I’ve pointed out in previous editorials, the hearing industry has historically been fairly resilient during recessions. In 2008, hearing aid sales went down by only 0.7% compared to 2007 (see Figure 1); during the recession of 2001-2002, unit sales decreased by about 1%. I’ve often thought this demonstrates that consumers—once they acknowledge their hearing loss—tend to think of hearing aids as a medical necessity rather than an electronic device.

Whatever the case, the second quarter of 2020 promises to be the historic steeply declining data point that all future market swoons will be judged against, with HR estimating about a 60-65% sales shortfall. The bottom line: we’ll get through Q2 2020 while preparing for better days! Be safe.

About the author: Karl Strom is editor in chief of The Hearing Review and has been reporting on hearing healthcare issues for over 25 years.

Citation for this article: Strom KE. Covid-19 and hearing aid sales. Hearing Review. 2020;27(5):6.