Business Development| February 2020 Hearing Review

Adding value to the patient experience requires change. The use of innovative products and technologies in a hearing healthcare practice is essential for survival—and it is expected by patients. Why send patients to the internet or electronic stores for products that can be offered in the practice and increase the patient experience? Why not use technology to improve practice procedures and efficiency?

By Robert M. Traynor, EdD, MBA

The competition within hearing care continues to be fierce. Practice differentiation is the key to instilling added value and an overall unexpected patient experience. Part 1 of this series1 covered the basics of developing a sound competitive strategy, while Part 2 showed that the patient experience was further enhanced by screening and monitoring the co-morbidities for hearing loss and updating the diagnostic audiological battery of tests.2,3 Part 3 discusses enhancing the patient experience by changing the clinic from a “Hearing Center” to a “Center for Hearing” with an array of products and innovative technologies.

Differentiation by Product Availability

Patients, especially the Baby Boomers, are skeptical of practices that only offer a single brand of hearing aids. It is good practice to incorporate at least three hearing aid manufacturer’s lines to treat patients. Typically, there is a favorite brand that has demonstrated its utility and substantial benefit to most patients, with a second or third (or more) “backup brands” that are deemed to serve some patients better, or as specialty products like power aids, CROS, and other special instruments for a specific patient populations. This ensures that, not only does the patient obtain the benefits of amplification, but the best product are offered for individual hearing situations.

Hunn4 indicates that in the short and medium terms, hearing aids are the primary component of the business of hearing care. Other products, however, are becoming an integral part of the equation. Clinics should stock an array of beneficial hearing care products for all levels of hearing impairment.

A survey conducted by ESCO5 indicated that 70% of the patients left the clinic and never returned after a diagnostic assessment, discussion of the hearing impairment, and presentation of a solution. Typical excuses are “I’m going to think about it,” “I want to talk it over with my spouse” or “do some research,” suggesting that something went wrong with the consultation and/or the products presented as the solution. While there are many reasons for patients not to return for treatment and/or hearing aid purchase, Baby Boomers feel that they are responsible for their hearing healthcare and usually do their research online. When researching online they not only find hearing aids, but also personal sound amplification products (PSAPs) and will in the future find an even wider variety of over-the-counter (OTC) hearing devices. In other words, their options will continue to broaden—as may that 70% figure.

In addition to traditional hearing instruments, products that should be considered in the clinical armamentarium are:

- Hearables (devices, apps, etc);

- AC/BC headsets and earbuds;

- Television and phone connectivity, loop systems, remote mics, and other assistive listening devices;

- Alerting/alarm devices;

- Hearing protection products;

- Musician monitoring systems, and

- PSAPs and OTC (when available).

This, of course, means you will need to become more familiar with these products and be able to recommend them to patients who can benefit from them. It’s no secret that margins can be substantially lower on hearables, ALDs, PSAPS, etc, but some of these products may require clinic time for assessment, counseling, fitting, and other treatment. Hearing professionals will need to charge for these services, and develop pricing models accordingly.6-8

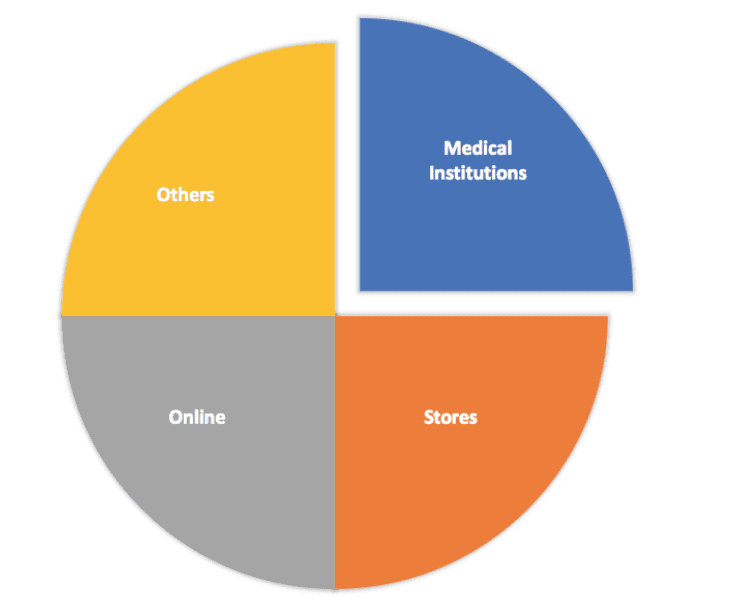

Market Intellica9 found that the market for hearing aids, PSAPs, and hearables will continue to grow at least until 2024, and that 25% of this growth in sales will be through medical institutions (Figure 1). Clearly, it makes business sense for a “Center for Hearing” to include products designed for consumers with normal or near-normal hearing. Basically, anything that is a hearing product should be available. Practices not embracing products to make them different may find decreased sales and profit, and a downward trend that is difficult to reverse.

Differentiation by Technology

Likewise, investing in new clinical and rehabilitative technologies can appear expensive, but adopting these advancements can prove to be highly cost effective. Baby Boomers “grew up” with technology, using these innovations routinely in their occupation and personal lives. Although these patients expect to see technology used in their hearing healthcare, it also benefits the clinician as new equipment can streamline processes and increase efficiency and productivity.

The initial costs may seem high; however, the use of new methods and equipment can lead to long-term growth and a distinct competitive advantage. The alternative is to carry on as usual, eventually leading to slow growth and even decline if new technology is not adopted quickly enough. If a practice wants to grow in this new competitive commoditized market, it is essential to stay up to date.

Top-9 Stand-out Technologies for 2020

While there are several methods of differentiation that can be adopted, either separately or in combination, the use of innovative technology truly separates one clinic from another by offering a distinctive departure from the mundane product and treatment options in the average hearing healthcare clinic. Winning practices realize that branding their practice is more than a sleek logo and/or a cool website; strategic branding is layered, sculpted, and tested, reflecting patient-centric needs and technological innovation.10

But you have to “walk the walk if you’re going to talk the talk.” Here are some of technologies and procedures that today’s hearing care clinics should employ or consider:

1) Office Management Systems (OMS). It is amazing how many clinics do not use office management systems. Today, there are many competitive systems that can be used to increase efficiency in the management of the patients and the data that they create. Additionally, systems that allow patients to schedule their own appointments online and download office forms, allow practices to cut down waiting room time and enhance the patient experience. Often these same systems allow the use of iPads to fill out the history and various forms in the waiting room and/or can be used for office surveys or to supplement your online presence.

2) Noah-connected equipment. Technology now allows clinics to have their audiometer, immittance, OAE, fitting systems, real-ear measurement and other systems connected. This allows the clinicians to access various evaluations and forms from one room to another all from their computer terminal. Efficiency, patient experience, and data access are all increased.

3) Automated audiometry and technicians. Other disciplines have assistants or technicians who conduct routine procedures and/or assist the professional, often using automated equipment. With automated audiometry, one patient can be finished while another begins their evaluation, and test results are interpreted by the clinician efficiently.

4) Teleaudiology. Some still view telehealth as a “future” development in audiology. But tele-audiology is now, and can provide you with differentiation and a sizable competitive advantage.11-14 Assisting patients “where they are” via telehealth is increasingly becoming expected by patients and healthcare administrators—and can be done today in a practice.

5) Cerumen management with microscopes and caloric irrigators. Microscopes are not just for ENTs anymore. While illegal in some states due to complex licensure laws, cerumen removal is a fundamental component of audiology practice and an essential skill for audiologists. A well-trained audiologist with a microscope and motorized chair not only adds to the ambience of the practice but simultaneously offers a highly professional and needed procedure. Further, for patients who require irrigation, there are now caloric irrigators that present a calculated flow of water at exact correct temperatures eliminating disequilibrium and water flow velocity issues.

6) Tinnitus management. Tinnitus management is a vital component of audiology practice, and we should be leading the way in this area. While we have known for some time that hearing devices can treat tinnitus, only slightly more than half of the tinnitus population experience relief.15 Although tinnitus treatment requires extra time for appointments, questionnaires, and tinnitus retraining therapy, it will present the practice at a level above other clinics.16 Some tinnitus, misophonia, and hyperacusis patients may require other sophisticated sound or psychological therapies.17

7) Ear scanners. In the 21st Century, scanning is how “impressions” should be taken. Scanning has potential for better accuracy, without the artifacts or ear canal angle issues. It also provides information about temporal mandibular joint (TMJ) movement and canal elasticity. Scanning also aids in the comfort and experience of the patient while significantly reducing clinical liability for issues such as mastoid bowls, abrasions, and other typical problems that can arise in the impression process.

8) Cochlear implant programming. Implant manufacturers are eager to have their products programmed as close to their patient’s home as possible. Programming implants is not a high revenue procedure, but it places a hearing healthcare practice at a higher level in the market in the eyes of consumers.

9) Balance assessment and treatment. Most communities lack audiologists who can diagnose and treat vestibular disorders. Long driving times to clinics that can provide these services are quite common. While the reimbursement is unimpressive, once these capabilities are known to medical professionals in the community, differentiation is certain. Medical professionals realize that a practice that works in hearing and balance disorders is a cut above those “just sell hearing aids.”

Conclusion

The use of innovative products and technology in a hearing healthcare practice is essential for survival—and it is expected by patients. Why send patients to the internet or electronic stores for products that can be offered in the practice and increase the patient experience? Why not use technology to improve practice procedures and efficiency?

Adding value to the practice experience requires change. The words of John F. Kennedy offer perspective: “Change is the law of life and those who look only to the past or present are certain to miss the future.”

CORRESPONDENCE can be addressed to Dr Traynor at: [email protected]

Citation for this article: Traynor RM. Competing in the new era of hearing healthcare part 3: Differentiating the practice with product and technology. Hearing Review. 2019;27(2):20-21.

References

1. Traynor, RM. Competing in the new era of hearing healthcare, part 1: Developing a sound competitive strategy. Hearing Review. 2019;26(9):20-23.

2. Traynor RM, Hall III JW. Competing in the new era of hearing healthcare, part 2: Differentiating a practice with comorbidity screening, monitoring and diagnostics. Hearing Review. 2019;26(11):16-19.

3. Carbone L. Clued-In: How to Keep Customers Coming Back Again and Again. Upper Saddle River, NJ: FT Press/Pearson;2004.

4. Hunn N. The expanding market for hearable devices. Nuheara. https://www.nuheara.com/news/expanding-market-hearable-devices/. Published March 2016.

5. Ear Service Company (ESCO). Consumer survey. Published 2015.

6. Balachandran R, Amlani AM. Service-delivery considerations of direct-to-consumer devices in the new age of rehabilitative hearing healthcare. Hearing Review. 2019;26(9):14-18.

7. Hearing Review’s State of the Industry-Dan Quall . YouTube. https://www.youtube.com/watch?v=rKedH4n9Yu0. Published July 30, 2014.

8. Quall D, Taylor B. Patient complexity and professional time: Improving efficiencies in the service model. Hearing Review. 2016;23(10):42.

9. Big Market Research. World industrial hearables market research report 2024, covering USA, Europe, China, Japan, India. August 2019. https://www.bigmarketresearch.com/report/3243532/world-industrial-hearables-market-research-report-2024-covering-usa-europe-china-japan-india-and-etc. Published August 2019.

10. Traynor R. Are you “clued-in” to offer the ultimate patient experience? Hearing Review. 2019;26(7):25-27.

11. Glista D. Phonak ABCs of eAudiology #2: 10 steps to optimizing your eAudiology practice environment. Hearing Review. https://hearingreview.com/uncategorized/phonak-abcs-of-eaudiology-2-10-steps-to-optimizing-your-eaudiology-practice-environment. Published August 26, 2019.

12. Northern JL. Extending hearing healthcare: Tele-audiology. Hearing Review. 2012;19(10):12-16.

13. Fabry D, Groth J. Teleaudiology: Friend or foe in the consumerism of hearing healthcare? Hearing Review. 2017;24(4):16-19.

14. Ballachanda B. Critical steps in establishing a teleaudiology practice. Hearing Review. 2017;24(1):14.

15. Kochkin S, Tyler R. Tinnitus treatment and the effectiveness of hearing aids: Hearing care professional perceptions. Hearing Review. 2008;15(13):14-18.

16. Piskosz M. How to establish a successful tinnitus clinic. Hearing Review. 2013;20(5):16-22.

17. Harvey MA. A psychological tool for managing tinnitus: Creating useful narratives. Hearing Review. 2018;25(3):22-24.