Business Management | September 2019 Hearing Review

Assessing and setting service fees for dealing with DTC and OTC hearing aids

The landscape of the US healthcare environment has transformed markedly over the past decade. This transformation is the result of four overarching trends1:

While hearing care professionals might perceive OTC/DTC as a threat or detrimental to their professional autonomy and livelihood, the intent of this article is to highlight that opportunities to meet the demand of listeners with impaired hearing exist through the provision of revenue-generating professional services. These service opportunities, we strongly believe, allow for the preservation of the independent practice channel for those practitioners who understand and recognize the economics of the transformed, and continually evolving, US hearing healthcare environment.

1) Advances in technology (eg, ranging from nanotechnology to digital health to the cognitive cloud);

2) Demand for value (ie, traditional payers and consumers are demanding increased quality, evidence, and transparency for fewer dollars);

3) The growing aging economy (ie, by 2030, 1 in 5 Americans will be over 65 years of age), and,

4) Government policy (eg, Medicaid expansion, 2010 Patient Protection and Affordable Care Act).

These trends were assessed for hearing healthcare in adults—including an emphasis on accessibility and affordability of audiological services and technologies—with the outcomes and recommendations relayed in two separate committee reports: the President’s Council of Advisors on Science and Technology (PCAST),2 and the National Academies of Science, Engineering, and Medicine (NASEM).3 A common recommendation from these reports was the establishment of a new category of over-the-counter (OTC) hearing devices by the US Food and Drug Administration (FDA).

This recommendation was included for legislation as a component of the FDA Reauthorization Act of 2017 (HR 2430) and signed into law in August 2017.4 This law authorized the FDA to develop regulations for OTC hearing aids—by 2020—for adults with perceived mild-to-moderate impaired hearing. According to the law, OTC is defined as a device that:

1) Is based on the same fundamental scientific technology as air conduction hearing aids (as defined in section 874.3300 of title 21, Code of Federal Regulations) or wireless air conduction hearing aids (as defined in section 874.3305 of title 21, Code of Federal Regulations);

2) Is intended for use by adults >18 years with perceived mild-to-moderate hearing impairment;

3) Provides the user with controls to customize and adjust the device to the user’s hearing needs;

4) Optionally offers:

- use of wireless technology, or

- includes tests for self-assessment of impaired hearing; and,

5) Is available direct-to-consumer (DTC) through in-person transactions, by mail, or online, and without the supervision, prescription, involvement, or intervention of a licensed person.

To date, the OTC market channel has no established distribution model, cost structure, and product performance characteristics. It should be noted that in May 2018, the Bose Hearing Aid, a DTC self-fitting device, received “De Novo” authorization (ie, a regulatory approval for previously, non-marketed products) from the FDA for marketing purposes.5

OTCs should not be confused with personal sound amplification products (PSAPs). While PSAPs are ear-level wearable devices that amplify sounds and available to the consumer as a DTC product, these devices are not regulated by the FDA and, thus, cannot be advertised as a solution for individuals with impaired hearing.6 The FDA states that PSAPs should be used by listeners with normal-hearing sensitivity to amplify soft sounds in environments, such as bird watching and listening to lectures with a talker located at a distance. However, it should also be pointed out that PSAPs, and all corresponding clinical services (eg, real-ear, counseling, communication strategies, etc), can be provided by a hearing care professional to qualified listeners.

Many herald the DTC purchasing model of ear-level amplification products (ie, OTCs, PSAPs) negatively for the profession and industry, mainly because:

1) Consumers who utilize the services provided by dispensing practitioners felt they were overpaying for a product in which the value of services was masked through a lack of itemized pricing transparency, and,

2) Consumers will have the opportunity to purchase and self-fit products—including FDA-approved (ie, OTC) devices—without consulting with a licensed hearing healthcare professional, and potentially put their health and/or residual hearing at risk or become discouraged when the devices don’t work for them, break down, etc.

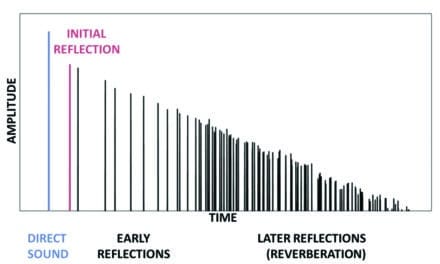

Whatever the pros and cons of DTC/OTC hearing devices, it is a fact that they are coming and almost certainly will, in some degree, affect the hearing healthcare market. We posit that the DTC purchasing model allows the dispensing practitioner to feature the accessibility and flexibility associated with evidence-based service provision of amplification products that yield benefits of improved aided audibility on quality of life to the user. The opportunities for a service-delivery model for DTC products are supported by research that indicates variability in self-prescribed gain among listeners compared to prescriptive gain (eg, NAL-NL2): 1) in quiet listening conditions, (2) in adverse signal-to-noise ratios (ie, –10 dB), and (3) in listener’s exhibiting 7,8

The purpose of this article is to provide the reader with service-delivery framework of DTC products—based on existing PSAP products—in consideration of the changing hearing healthcare distribution environment.

DTC Products

To understand the potential service-delivery opportunities available with DTC products, we created a spreadsheet of 117 unique PSAP devices available for online acquisition between November 2018 and March 2019. Data for the spreadsheet were adopted from three online websites: Amazon.com (US), Hearing Tracker.com, and OaktreeProducts.com. We recorded five device attributes, including: a) Product features (eg, type of microphone[s], noise reduction, feedback cancellation, number of memories); b) The degree to which these features could be programmed and controlled by the user; c) the extent to which an audiogram was required; d) the type (eg, in-house, remote) and level of external professional support provided, and e) the retail price. From this data, we established three product levels based on programmability and controllability, shown in Table 1.

![Table 1. [Click on Image to enlarge.] PSAP products categorized into three classes based on customization features, as well as services, cost, and product examples.](/wp-content/uploads/2019/12/Balachanran_Services_Table1-300x161.png)

Table 1. [Click on Image to enlarge.] PSAP products categorized into three classes based on customization features, as well as services, cost, and product examples.

![Table 2. [Click on image to enlarge.] Revenue from professional services are calculated in 15-minute intervals based on a break-even analysis for a hypothetical practice. See text for details.](/wp-content/uploads/2019/12/Balachanran_Services_Table2-300x277.png)

Table 2. [Click on image to enlarge.] Revenue from professional services are calculated in 15-minute intervals based on a break-even analysis for a hypothetical practice. See text for details.

Revenue Opportunities Based on Service Delivery

Based on the product categories displayed in Table 1, we tabulated potential revenue opportunities for time plus complexity based on service delivery (Table 2). Time, or revenue per hour, was generated by calculating the unbundled hourly rate of the practice (U):

U=Ei/Ci

…where total annual expenses Ei include Personnel Expenses (eg, salaries, benefits) + Clinic Expenses (eg, rent, utilities, office supplies), but excludes cost of goods (COGs), and Ci represents the product of Patient Contact Hours Weekly (eg, 35) ×Annual Operating Weeks (eg, 48) ×Number of Full-Time Providers (eg, 2). For Table 2, U equaled roughly $100/hour based on Ei estimated at $330,000 and Ci yielding a value of 3360 hours (ie, 35 contact hours ×48 operating weeks ×2 full-time providers).

For complexity,9 we determined a flat-rate professional fee of $50 for devices in Category 1, $100 for devices in Category 2, and $150 for devices in Category 3, as seen in Table 1. The complexity model for professional services considers three aspects of audiological care:

1) Assessment (ie, evaluation/selection of tests);

2) Clinical decision-making (ie, interpreting/reviewing results, selecting treatment options), and,

3) Counseling (ie, presentation of findings and options).

To determine the professional flat fee, we generated a set of coefficients ranging from 1 to 3, in 1-unit increments, for the three categories. These coefficients were then multiplied by $50, which we derived from:

U/2

The professional flat fee is an expense item that the consumer pays at the initial and any subsequent visits.

The perceptive reader will note that the potential service-only revenue stream displayed in Table 2 is far less than the traditional bundled revenue the market has cherished historically. Given this fact, the decision to engage in the DTC channel is definitely not ideal for all practices. Our preliminary calculations—based on national averages—indicate that the DTC service channel could be an opportunity for growth in those practices that are still maturing (eg, averaging between 5 and 14 traditional units/monthly). Authors’ note: For practices that differ from national averages, please use caution with respect to the recommendations and outcomes reported. Additionally, the professional flat fees presented in this article are meant only as examples for the formulation of service fee rates.

To illustrate, assume a moderate-sized practice employs two practitioners who together dispense an average of 14 units/month (ie, 168 units annually). The annual gross revenue from hearing aid sales for this practice equates to $369,600 (168 units ×$2200/unit). We estimate the market cannibalization from DTC products to be 20%, meaning that roughly 1.8 million Americans (ie, based on a demand for technology by roughly 9 million adults with impaired hearing) who are candidates for traditional hearing aids will purchase a DTC product instead. Thus, this practice can assume that its annual units will decrease from 168 to 135, yielding a gross revenue decrease of $72,600 (ie, 33 units ×$2200/unit).

Proactively preparing to reduce the degree of cannibalization to the point of “breaking even,” and, ideally revenue generating, is contingent on providing service-based professional care. Using a 4-hour block-scheduling of patients per provider, there is an opportunity for each practitioner to serve between 4 and 6 patients who already possess DTC products. Assuming an average service plus professional fee of $175—based on the example provided in Table 2—and an average of 5 patients per week, the practitioners will generate an estimated $1750 combined (ie, $175 service fee ×5 patients ×2 practitioners). Over the course of a month, the practice will have increased its gross revenue stream by $6000, which annualizes to $84,000 (ie, 48 operating weeks ×$1500). The annual gross revenue of $84,000 (ie, cash revenue minus personnel and clinic expenses, and no COGs), not only recoups tentatively lost revenue (ie, in our example, an estimated $72,600) from the competing DTC channel, but increases revenue by $11,400 (ie, $84,000–$72,600).

Other Opportunities

Industry trends indicate that the average cost to acquire a new patient ranges between $256 and $450 per patient.10 In addition, hearing clinics allot roughly 3% of their gross revenue (ie, median expenditure of $15,000) on marketing strategies dedicated to new patient acquisition and patient loyalty.11

The provision of a service-delivery model for alternative product channels offers practitioners opportunities to impact their practices positively with passive marketing benefits and lower overhead costs, such as:

- Building direct patient relationships and loyalty;

- Increase practice brand;

- Word-of-mouth marketing, and,

- Educating patients on the need for and benefits of audiological services.

Summary

The primary catalysts for the creation of the DTC channel in hearing healthcare was a lack of pricing transparency (ie, perceived professional value) and an archaic service delivery model to acquire amplification for consumers. These factors led to the passing of a bill affording the average American with opportunities to improve their long-term hearing healthcare through the early use of amplification, rehabilitation, and consistent and comprehensive hearing care solutions.

While providers might perceive this bill as detrimental to their professional autonomy and livelihood, the intent of this article is to highlight that opportunities to meet the demand of listeners with impaired hearing that exist through the supply of revenue-generating, professional services. These service opportunities, we strongly believe, allow for the preservation of the independent practice channel for those practitioners who understand and recognize the economics of the transformed, and continually evolving, US hearing healthcare environment.

Acknowledgement

The views expressed in this article are solely those of the authors and do not necessarily reflect those of Audigy Group.

Correspondence can be addressed to Dr Balachandran at: [email protected]

Citation for this article: Balachandran R, Amlani AM. Service-delivery considerations of direct-to-consumer devices in the new age of rehabilitative hearing healthcare. Hearing Review. 2019;26(9):14-18.

Rupa Balachandran, PhD, is an Associate Professor in the Department of Audiology at the University of the Pacific, San Francisco. Amyn M. Amlani, PhD, is the Director of New Practice Development at Audigy, a data-driven, US management group for audiology and hearing care, ENT group, and allergy practices. Prior to this position, Dr Amlani was an academician for nearly two decades.

References

-

Santilli J, Vogenberg FR. Key strategic trends that impact healthcare decision-making and stakeholder roles in the new marketplace. Am Health Drug Benefits. 2015;8(1):15-20.

-

President’s Council of Advisors on Science and Technology (PCAST). Aging America and Hearing Loss: Imperative of Improved Hearing Technologies. https://obamawhitehouse.archives.gov/sites/default/files/microsites/ostp/PCAST/pcast_hearing_tech_letterreport_final.pdf. Published September 2015.

-

The National Academies of Sciences, Engineering, and Medicine (NASEM). Hearing Health Care for Adults: Priorities for Improving Access and Affordability. http://nationalacademies.org/hmd/reports/2016/Hearing-Health-Care-for-Adults.aspx. Published June 2, 2016.

-

US Food and Drug Administration. FDA Reauthorization Act of 2017 (2017, August 18), Pub. L. No. 115-52 PS. https://www.congress.gov/115/plaws/publ52/PLAW-115publ52.pdf

-

FDA allows marketing of first-self-fitting hearing aid controlled by the user [news release]. Washington DC. October 5, 2018. https://www.fda.gov/news-events/press-announcements/fda-allows-marketing-first-self-fitting-hearing-aid-controlled-user.

-

US Food and Drug Administration. Regulatory Requirements for Hearing Aid Devices and Personal Sound Amplification Products: Draft Guidance for Industry and Food and Drug Administration staff. http://www.fda.gov/downloads/MedicalDevices/DeviceRegulationandGuidance/GuidanceDocuments/UCM373747.pdf. Published November 7, 2013.

-

Nelson PB, Perry TT, Gregan M, Van Tasell D. Self-adjusted amplification parameters produce large between-subject variability and preserve speech intelligibility. Trends in Hearing. 2018;22:1-13.

-

Perry TT, Nelson PB, Van Tasell DJ. Listener factors explain little variability in self-adjusted hearing aid gain. Trends in Hearing. 2019;23:1-17.

-

Windmill IM, Bishop C, Elkins A, Johnson MF, Sturdivant G. Patient complexity charge matrix for audiology services: A new perspective on unbundling. Seminars in Hearing. 2016;37(2):148-160.

-

AudiologyPlus. Top digital strategies for impressive patient retention. https://audiologyplus.com/2018/02/28/top-digital-strategies-for-impressive-patient-retention/.

-

Phonak Marketing. 2013 survey of US dispensing practice metrics, Part 1. Hearing Review. 2013;20(12):24-33.