By Karl Strom, editor

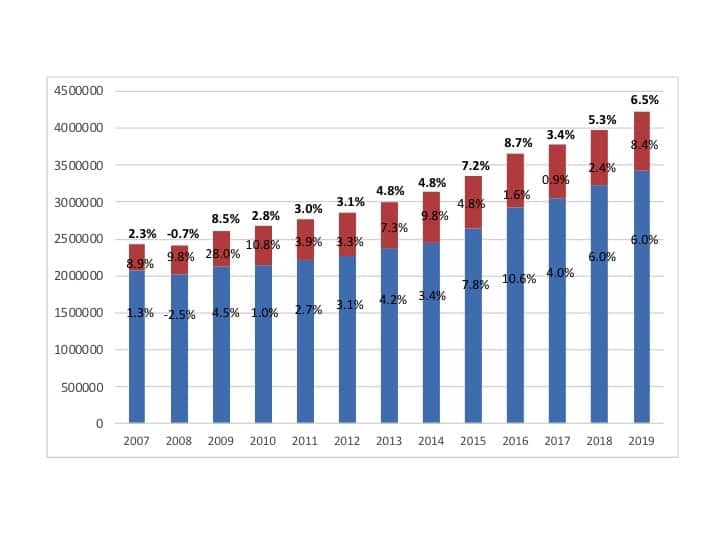

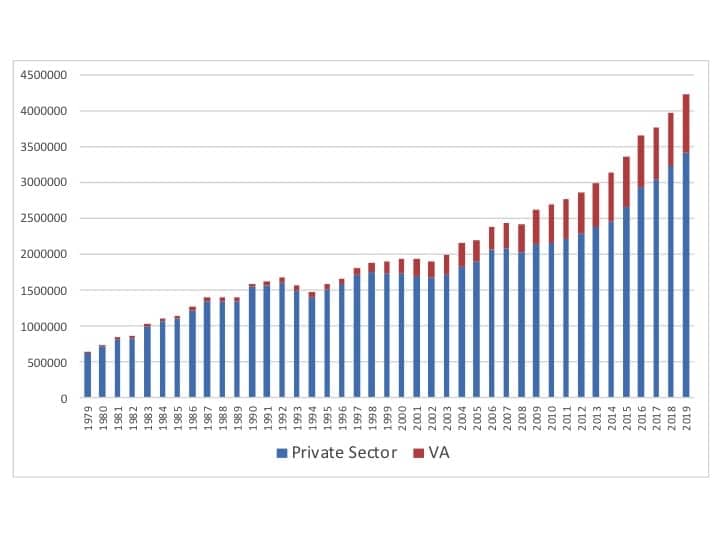

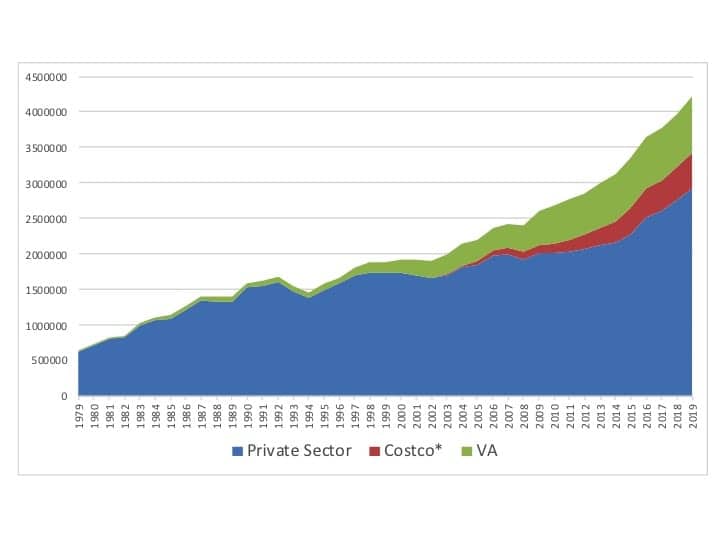

Hearing aid unit sales in the United States during 2019 topped 4.23 million for a 6.5% increase compared with 2018 sales (3.97 million units, or a 5.3% increase over 2017)—officially breaking the 4 million-unit mark (Figure 1), according to statistics generated by the Hearing Industries Association, Washington, DC. The sales increase was helped by an unusually strong fourth quarter that saw overall sales increase by 11.3% over the same period last year, with double-digit increases for both the VA and private sector (10.1% and 11.6%, respectively). Third-quarter sales had also been relatively strong with 7.2% overall unit gains.

The US hearing aid market has now experienced an unprecedented 11-year run of positive net unit sales going back to the stock market crash of 2008 (Figure 2). Additionally, year-end sales have exceeded 4% in 6 of the 7 years from 2013-2019.

In 2019, private/commercial market hearing aid unit sales increased by 6.0%, and units dispensed by the VA—which accounted for about one-fifth (19.1%) of all hearing aids sold in the United States—increased by 8.4%. This follows 2018 unit growth of 6.0% and 2.4% for the private sector and VA, respectively (5.3% total).

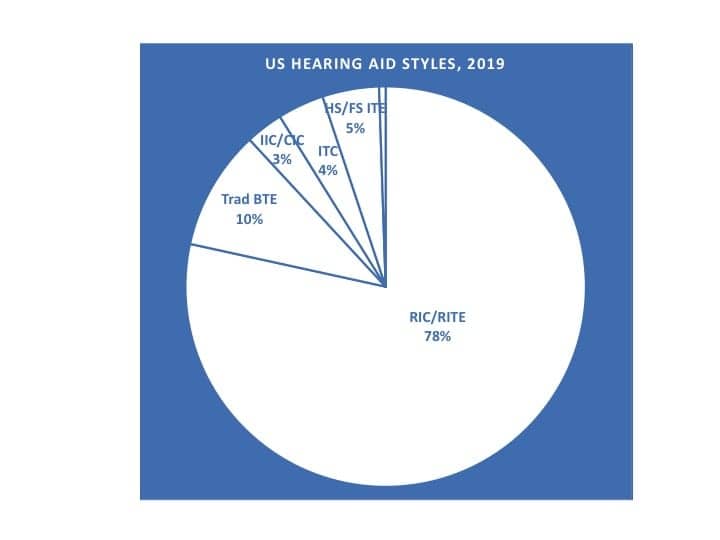

Hearing Aid Styles

The trend toward receiver-in-the-canal (RIC/RITE) style hearing aids continued, as well (Figure 3). RICs made up over three-quarters (78.4%) of all hearing aids sold in the United States during 2019, while traditional BTEs constituted 9.7%. Thus, BTE-type hearing aids accounted for nearly 9 in 10 (88.1%) of all hearing aids sold. Three years previously, in 2016, RICs accounted for two-thirds (66%) of the market, while traditional BTEs accounted for 15%.

In 2019, half-shell and full-shell in-the-canal ( HS/FS ITE) styles made up 4.6% of all units sold; in-the-canal (ITC) 3.8%; and invisible-in-the-canal and completely-in-the-canal (IIC/CIC) styles accounted for 3.0% of all units sold (with 0.5% classified as “other ITEs”).

Other Market Considerations

Hearing Review has pointed out in many market updates that—with the advent of big box and other mass distributors of hearing aids which are counted as “private sector” sales—HIA numbers have become more opaque relative to how traditional independent dispensing offices are faring. Likewise, in more recent years, sales at IntriCon (which supplies branded hearing aids to distributors) have also been included in the HIA statistics, and it remains unknown how large retailers, notably Costco, are influencing the private sector statistics.

But one can venture a guess…It would appear Costco continues to gain ground and constitutes a sizable share of the US market, with HR estimating that the mass retailer accounted for about 14% of all US hearing aids dispensed in 2019 (Figure 4). It should be emphasized that these estimates are based only on general market observations, with Costco’s growth pegged between 6-8% for the last 3 years. The retailer has never publicly released hearing aid sales figures.

However, even given Costco’s notable contribution to US hearing aid sales, it can be seen that the rest of the private sector is seeing solid unit growth.

Karl Strom is editor in chief of The Hearing Review and has been reporting on hearing healthcare issues for over 25 years.