![[Click on images to enlarge.] Annual US net unit hearing aid sales for the private/commercial (blue) and VA (red) markets, with year-on-year percentages for each and overall sales increases in bold at the top. Source: HIA.](https://hearingreview.com/wp-content/uploads/2019/01/HASales07-18-e1547666400690-300x227.jpg)

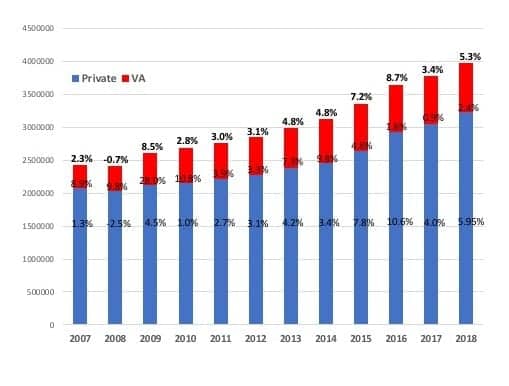

[Click on images to enlarge.] Annual US net unit hearing aid sales for the private/commercial (blue) and VA (red) markets, with year-on-year percentages for each and overall sales increases in bold at the top. Source: HIA.

Perhaps reflecting consumers’ uncertainty about the overall economy, the HIA statistics show that overall hearing aid sales in the fourth quarter (Q4) of 2018 slowed slightly to 3.4%, after experiencing a 5.73% increase in both Q1 and Q2, and a 6.2% increase in Q3. The private sector posted a 3.2% gain in Q4, after relatively strong growth of 6.2-7.3% in the first three quarters. The VA experienced its first unit gains in Q3 and Q4 (6.4% and 4.2%, respectively) since the first quarter of 2016.

Traditionally, market experts have thought of 2-4% growth in the United States as “normal.” With 2018’s overall sales increase of 5.3%, yearly hearing aid unit sales have now increased by about 5% in 5 of the last 6 years. Overall sales have averaged 5.15% in the last 10 years, and 5.8% in the last 5 years. Private-sector sales have averaged 4.8% in the last 10 years and 6.3% in the last 5 years. VA percentages are 7.3% and 4.2%, respectively, although the VA’s 3-year average is only 1.6%.

Hearing Review has pointed out in many market updates that—with the advent of big box and other mass distributors of hearing aids which are counted as “private sector” sales—HIA numbers have become more opaque relative to how the traditional independent dispensing office is faring. Likewise, in more recent years, sales at IntriCon (which supplies branded hearing aids to distributors) have also been included in the HIA statistics.

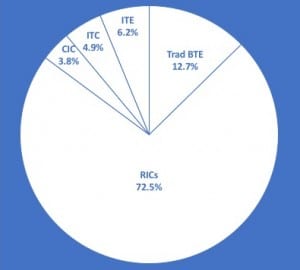

In terms of hearing aid styles, more than 85% of all hearing aids in 2018 were BTE-type devices: Reciever-in-the-canal (RIC) hearing aids accounted for 72.5% of all hearing aids dispensed in 2018, while traditional BTEs made up 12.7%. Relative to in-the-ear (ITE) hearing aids, in-the-canal (ITC) aids made up 4.9% of all hearing aids dispensed; completely-in-the-canal (CIC) 3.8%; full-shell ITEs 4.0%; half-shell ITEs 1.6%, and “other ITEs” 0.6%.

The industry was tantalizingly close to hitting the 4-million unit mark, with 3,969,895 units sold in 2018. Hearing Review predicted in early-December that hearing aid sales would total 3.98 million units and hopefully hit the 4-million mark by the end of 2019.

HIA is the trade organization of hearing aid and hearing-related product manufacturers in North America, and its 2018 statistics are based on the monthly sales reports of 14 companies, including all of the major global manufacturers of hearing aids. Its statistics are generally thought to account for around 95% of all US hearing aids sales.

It’s terrific that the VA supplies ha’s at no charge to veterans, however the rest are forced to charge on a credit card or loan. We need organizations such as yours to compel health care plans to include hearing aids as a benefit. In the last few years, more and more plans have dropped the benefit. This is an outrage!

I am working full time with health insurance. I have a dental and vision plan, as well as ‘in case I get’ cancer supplemental plan, but no option for hearing aids.

Let’s fix this!