Practice Management | November 2021 Hearing Review

Part 3: How to Survive and Thrive in this Brave New World of Hearing Healthcare

By Carrie Meyer, AuD, and Adam Kerst, MBA

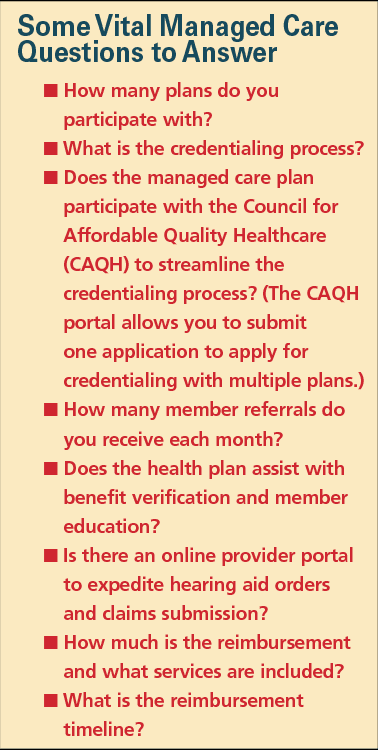

Getting answers to important questions about managed care and how it fits in your unique practice is vital. Here are some basic business calculations and metrics for understanding how a managed care plan might benefit, or not benefit, your practice.

As 2021 draws to a close, it is inarguable that the world is a very different place. The pandemic has changed us all mentally, emotionally, and professionally. In hearing healthcare, seismic events including OTC and Medicare legislation, Medicare Advantage expansion and the ongoing shortage of audiologists were already changing the landscape prior to the pandemic.1

In this new and challenging environment, hearing healthcare professionals need to make well-informed decisions to sustain and grow their practices. Part 1 and Part 2 of this series offered an introduction to managed care and presented common concerns about participation in managed care plans by hearing care professionals, respectively.2,3 This third and final article will explore the questions providers should ask and the information they must know to determine which managed care plans are the best fit for their practices and their patients. With research and careful consideration, it is possible to partner with and profit from participation in managed care.

Ask Questions

Like any business, a hearing healthcare practice must consider the environment in which it functions. As you begin to assess if managed care make sense for your practice, look outside your clinic walls and consider how many managed care plans are active in your area. Investigate the employers in your community and which managed care plans they provide for their employees. Finally, look at your competitors. Health plans use a network of credentialed providers and only refer to providers in their network. If your competitor is a network provider and you are not, those referrals will be flowing into their practice, not yours.

Do the Math

AuD programs provide classes in practice management, recognizing that business knowledge is critical to today’s clinicians. It is a stressful balancing act to provide outstanding patient care and run a profitable business. The best way to achieve success is to work with tax, legal, and accounting professionals to make certain that your practice is built on and maintains sound business practices. When considering participating in managed care or to determine your pricing structure for private pay patients, there are some basic business calculations that you should know.

Gross Profit. The amount by which sales, also called revenue, exceeds costs in a business is the gross profit. Take the amount of the sale and reduce by the cost of goods—items such as hearing aids and accessories.

Gross Profit = Revenue – Cost of Goods

Hearing aid technology tier, cost, and pricing must be evaluated to confirm that you have established an adequate profit for all products sold. This will sustain your business and increase income. It can be easier to generate more profit on high-end devices, but it may be more appropriate to use a similar profit margin for all technology tiers to reduce the financial impact of selling a more profitable device versus a less profitable device. This will generate more consistent profits regardless of technology tier and avoid incentivizing the recommendation of premier products when mid- or lower-technology tiers may be more appropriate.

Gross Profit Margin: Gross profit margin gauges the degree to which a company or a business activity makes money, essentially by dividing income by revenues. Expressed as a percentage, profit margin indicates how many cents of profit has been generated for each dollar of sale.

Variable Costs: While gross profit generally focuses on the sale and cost of the items, variable costs are those which you incur as a direct result of the sale. For example, if 5% of sales are paid as a dividend to a provider, these costs would be variable. The easy way to determine if something is variable is to ask, “If I had no sales this month, would I pay this?”

Fixed Cost: A fixed cost is a cost that does not change with an increase or decrease in the amount of goods or services produced or sold. Fixed costs are expenses that must be paid independent of any specific business activities. Examples include salaries, loan payments, interest, rent, utilities, etc.

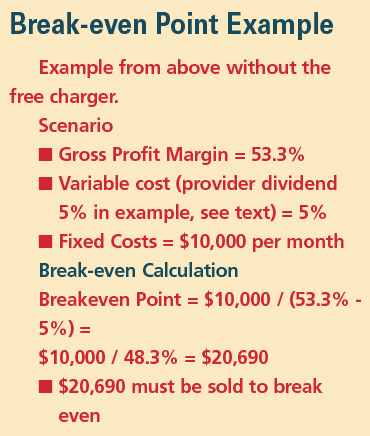

To cover fixed costs, practices must generate enough revenue to meet expenses and cover the cost of goods. This is measured by the breakeven point.

Break-even Point: The break-even point is the point at which total cost and total revenue are equal. When there is no net loss or gain, one has “broken even.” Once sales exceed the break-even point, net profits are generated, so this tells you the minimum number of sales needed to be profitable.

Having a clear understanding of your break-even point is critical to the health of your business. If your break-even point is too high, you either must increase your gross profits (ie, dispense more hearing aids, increase prices, etc) or reduce your expenses.

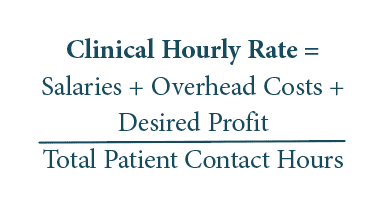

Clinical Hourly Rate: Use your hourly rate to determine what revenue every clinical appointment—diagnostic testing, hearing aid assessment, hearing aid fitting, and follow-up—must generate to achieve the income you want your practice to have. You can use your hourly rate to determine if a managed care plan meets your income criteria and how many managed care plans you should participate with to meet your profit goals. Clinical hourly rate is calculated by:

In larger practices, some owner/managers calculate the clinical hourly rates for each dispensing professional (keeping in mind that higher-profit procedures are not always evenly distributed between staff members).

Patient acquisition cost is the amount of money spent to convert a possible patient into an actual patient. In addition to the overhead costs you have already calculated, you must add your practice’s marketing costs. One positive aspect of managed care is there are no acquisition costs for patient referrals. The 2019 MarkeTrak 10 survey4 shows that having health plan coverage for hearing aids would be the single biggest motivator for nonusers to consider purchasing hearing aids. Managed care referrals are qualified leads—patients who are motivated to seek treatment for hearing loss, who use their benefit to purchase hearing aids, and are less likely to return their aids.5

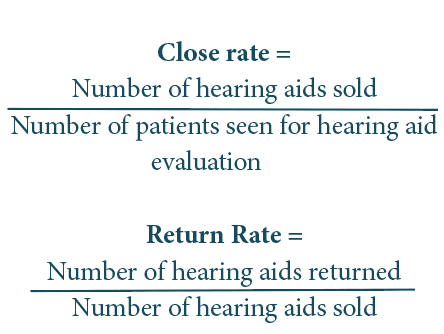

In addition to acquisition cost, you should determine your close and return rate.6 These are simple calculations:

Use of clinical best practices ensures that patients who need hearing aids purchase hearing aids and continue to wear their hearing aids. Motivational interviewing, using communication assessments to target patient concerns and needs, following recommended guidelines for evaluation, and using real-ear measurement to verify every hearing aid fitting will improve both your close and return rates.7-9

Customize to Meet Your Own Practice and Business Goals

Every hearing healthcare practice is different. Many focus primarily on hearing aid dispensing, while others specialize in implantable devices, balance assessment, tinnitus management, and auditory processing disorders. Managed-care plans are also varied and unique. There is no perfect match, and one size does not fit all.

What patient mix works for your practice? What is your practice mix (private pay patients versus managed care)? What patient ratio provides the profit you need or desire? With the expansion of Medicare Advantage plans and more managed care plans offering hearing benefits, it is increasingly difficult to build a practice solely on private-pay patients. Some practices choose to provide a more deluxe concierge-type service and other practices have moved to unbundling or ala carte style pricing structures.

Most practices, however, now choose to contract with managed care plans to accommodate local employers, increase patient referrals, and improve accessibility for patients in their community. By using your break-even point and clinical hourly rate, you can determine how many managed care patients your practice can profitably see each month when balanced with higher revenue private-pay patients.

How will your schedule support your practice goals? In a hearing aid dispensing practice, after-care and follow-up visits can create scheduling and income headaches. Post-fitting counseling and adjustments are critical to patient satisfaction and long-term success. Satisfied patients who consistently wear their hearing aids will need routine maintenance and repairs. Unfortunately, these time-consuming appointments generate very little if any revenue. What is the composition of your daily schedule—how many revenue generating appointments are seen each day? Carefully review scheduling to make sure that each week contains a mix of appointment and patient types that supports a positive revenue stream. Consider using an audiology assistant for maintenance visits and walk-in patients to maximize provider’s time and minimize schedule disruptions.

Conclusion

In hearing healthcare in the 21st century the only constant is change. By following sound business practices and considering the geographic location and unique needs of your practice, you can select and participate in managed care plans that improve accessibility and affordability for your patients while still creating a profitable revenue stream for your practice. Not every plan is the right fit, but some will provide no-cost referrals and improve your practice’s visibility within your community.

Providers who are creative, flexible, and aware of their practices’ unique potential can embrace the challenges change brings and create a vibrant, patient-centered practice that is profitable and sustainable. The information in these three articles is intended to provide guidance and support as you investigate what works best for you, your practice, and your patients as you navigate your way to success in this challenging and exciting new world.

CORRESPONDENCE can be addressed to HR or Dr Meyer at: [email protected].

Citation for this article: Meyer C, Kerst A. How to manage in managed care, Part 3: How to survive and thrive in this brave new world of hearing healthcare. Hearing Review. 2021 Nov;28(11):24-26.

References

- Kawa L. Older Americans are retiring in droves. Bloomberg. https://www.bloomberg.com/news/articles/2017-01-06/older-americans-are-retiring-in-droves. Published January 6, 2017.

- Meyer C. How to manage in managed care, Part 1: An introduction to managed care and its many parts and permutations. Hearing Review. 2021;28(9):24-27.

- Meyer C. How to manage in managed care, Part 2: Addressing business and clinical concerns for hearing care professionals. Hearing Review. 2021;28(10):24-27.

- Powers TA, Rogin CM. MarkeTrak 10: Hearing aids in an era of disruption and DTC/OTC devices. Hearing Review. 2019;26(8):12-20.

- Taylor B, Greene P. Signia Podcast Series: Successfully navigating the shift in third-party reimbursements post Covid-19. https://www.audiologyonline.com/audiology-ceus/course/signia-podcast-series-successfully-navigating-35468. Published August 27, 2020.

- Rudden D. Can you hear me now? Marketing essentials for audiologists in a noisy health care world. Seminars Hearing. 2016; 37(4):325-339.

- Citron D. Motivational Interviewing in audiology: How to become an appreciative ally. Hear Jour. 2020;73(1):32-33.

- Jorgensen LE. Verification and validation of hearing aids: Opportunity not an obstacle. J Otology. 2016;11(2):57-62.

- Amlani AM, Pumford J, Gessling E. Real-ear measurement and its impact on aided audibility and patient loyalty. Hearing Review. 2017;24(10):12-21.