By Karl Strom, editor-in-chief

A net total of 2,852,535 hearing aids were dispensed in the United States during 2012, for an increase of  Karl Strom, editor-in-chief

Karl Strom, editor-in-chief

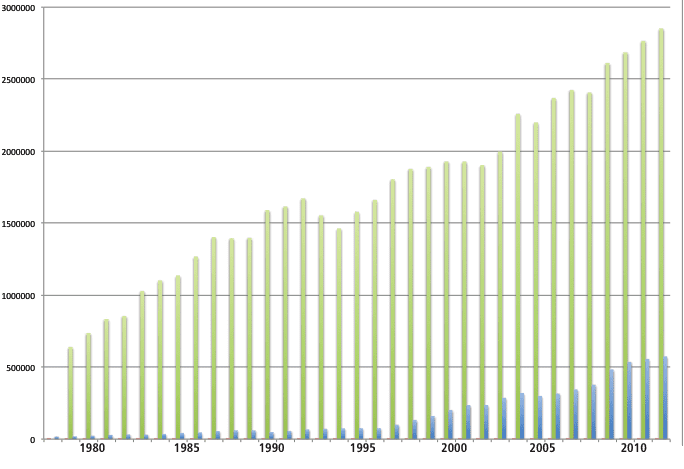

2.9% over the previous year, according to statistics released in January by the Hearing Industries Association (HIA), Washington, DC. Private sector (non-VA) unit sales rose by 2.8% in 2012, while Veterans Administration dispensing activity increased by 3.2% (Figure 1). The VA now constitutes 20.2% of the entire US hearing instrument market.

Looking at the fourth quarter of 2012 (Q4), net hearing aid sales increased by 2.4%. Private-sector dispensers experienced, on average, a sales increase of 2.5%, while the VA saw slightly lower unit volume growth (2.2%).

As noted in the November 2012 HR Staff Standpoint, dispensing activity in Q3 was relatively flat (1% increase over 2011), so a soft fourth quarter was expected—particularly in light of the uncertainty surrounding the US elections, the world economy, and the divisive “fiscal cliff” negotiations taking place in Congress. Although it’s true that the overall 2.9% unit increase places 2012 sales on the lower end of the industry’s historic 3% to 4% sales growth average, when placed in perspective, these numbers can be thought of as “not great, but not terrible.”

Behind-the-ear (BTE) hearing aids constituted 70.7% of the entire US market in 2012, which was about the same as 2011 (69.9%). However, BTEs with external receivers (RICs and RITEs) continued to consume a larger portion of market share. These aids represented 64.6% of all BTEs—or almost half (45.6%) of all hearing aids sold in the United States during 2012. In 2011, they represented only about half (49.3%) of all BTEs and one-third (34.4%) of the entire market.

None of the above statistics could be characterized as very surprising. Since witnessing a 0.7% decrease in 2008 and a fairly large recovery (8.5% increase) in 2009, the hearing aid market has experienced predictable, albeit modest, growth rates hovering around the traditional 3% to 4% industry growth rate (2.8% in 2010, 3.0% in 2011, and 3.1% in 2012). In general, industry analysts are predicting more of the same during the first two quarters of 2013, with a possible pickup in sales during the second half of the year. Of great interest is if the new lineup of premium hearing instruments launched last fall at the German EUHA Congress, as well as those that will be introduced in the first half of this year, will positively influence average sales prices, which have been decreasing by 1% to 2% in the last couple of years (see January 2013 Staff Standpoint).

Due to a recovering economy (fingers crossed), new technology, and quite possibly pent-up consumer demand, the numbers suggest that 2013 holds more promise for the hearing industry than any year since the economic crash of 2008.