Revised on January 25, 2022

By Karl Strom, editor

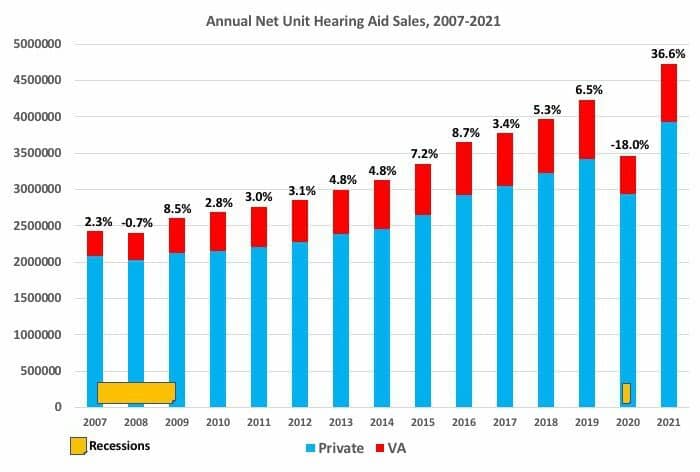

Hearing aid dispensing, particularly in the private sector, rebounded impressively in 2021, according to statistics generated by the Hearing Industries Association (HIA), Washington, DC, whose members are thought to comprise over 90% of the hearing aid units dispensed in the United States. Recovering from the pandemic/recession of 2020, US sales of hearing aids increased by 36.6%, totaling 4.73 million net units, which was equal to the amount predicted in Hearing Review‘s mid-year market review (Figure 1). Private practice and commercial net unit sales rose by 34.0%, while units dispensed at the US Department of Veterans Affairs (VA) increased by 50.4%.

Great News…Except You Must Consider 2020 Sales

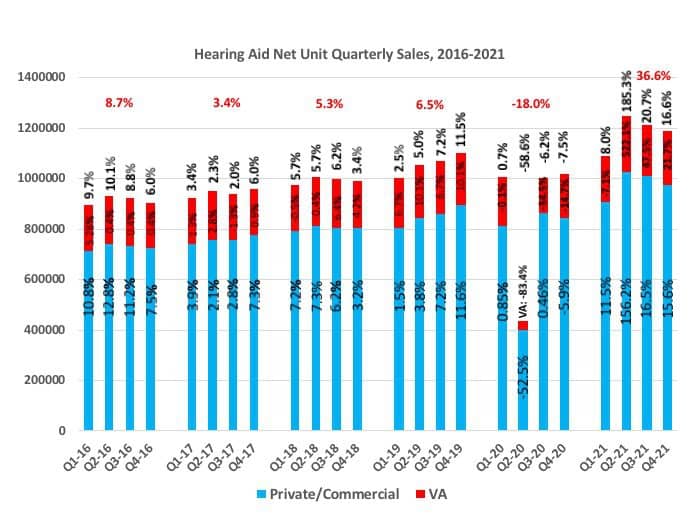

Although these are impressive numbers, they need to be put into context of the near-catastrophic business climate during the onset of the pandemic in 2020. As noted by Hearing Review, hearing aid sales fell by 58.6% in the second quarter (Q2) of 2020, and the pandemic continued to depress the market in the second half by 6.9% compared to the same periods in 2019 (Figure 2). During Q2 2020, dispensing at the VA came to a near-standstill (an 83% decrease) while sales in the private sector were halved (a 52.5% decrease). According to HR’s Covid Impact Survey #2 (April 9-17, 2020), less than one-third (31%) of private-practice or retail hearing care offices were physically seeing patients, and most of those with restricted office hours. In May 2020, one-quarter (25%) of private and retail hearing care practices indicated the government PPP loans were essential for survival, and businesses only began returning to normal starting around June. In total, hearing aid sales fell by 18% in 2020, with the private/commercial sector experiencing a decrease of 14.2% and the VA a decrease of 34.0% (Figure 3). Therefore the comparison base for 2021 sales is at a historically low level.

Strong Recovery with Slight Lag in VA Dispensing

However, what HIA’s 2021 sales figures indicate is a fast recovery for the private market (which includes private practices, clinics, hospitals, and mass retailers like Costco) and a slower recovery for the VA (Figure 3). This can especially be seen by comparing 2021 HIA figures to the pre-pandemic sales of 2019.

When compared to unit sales from 2 years ago (2019), private/commercial practice sales in 2021 increased by 15% while the VA decreased its units dispensed by -0.7% (Table 1). In particular, the VA experienced a -7.2% shortfall in units dispensed during Q1 2021 compared to the same period in 2019, which coincided with a second wave of Covid-19 cases that may have put the brakes on dispensing to eligible service members. Although the Covid-19 vaccines began to appear in December 2020, recall that a second wave of cases occurred at different times and in different regions, most markedly during the first quarter of 2021.

Like the VA, the private/commercial market also had a slightly slower sales recovery rate (12% increase) in Q1 2021 than in the remainder of the year—but still healthy growth. Private sector hearing aid sales kicked into high gear in Q2 and Q3, with sales 21.8% and 17.1% higher than in 2019, respectively (Figure 2). By this same gauge, the fourth quarter of 2021 saw a slower sales growth rate of 8.7%, albeit against a relatively strong comparison base in 2019.

According to the HIA statistics, the VA dispensed about 6,000 fewer hearing aids in 2021 than in 2019, while the private sector dispensed over 511,000 more. When comparing 2-year compound annual growth rates (CAGR) of the private sector to the VA from YE2019 through 2021, the private sector had a CAGR of 7.2% while the VA had a CAGR of -0.37%. Over the last 15 years, the overall unit CAGR for the US hearing aid market is 4.9%, with 4.7% for the private sector and 6.2% for the VA.

What’s ahead in 2022? Given these numbers—and assuming the omicron virus doesn’t pose more serious barriers to dispensing than did the delta virus—one might expect the VA to start making up more ground and addressing pent-up demand in 2022, and/or accelerating its use of private-sector audiologists and hearing aid specialists. The larger question is if the slightly lower sales growth for the private sector during Q4 2021 (a 8.7% increase as opposed to much larger increases in Q2 and Q3) is due to the gradual exhaustion of pent-up demand or simply a pause in double-digit growth.

State-by-State Hearing Aid Sales

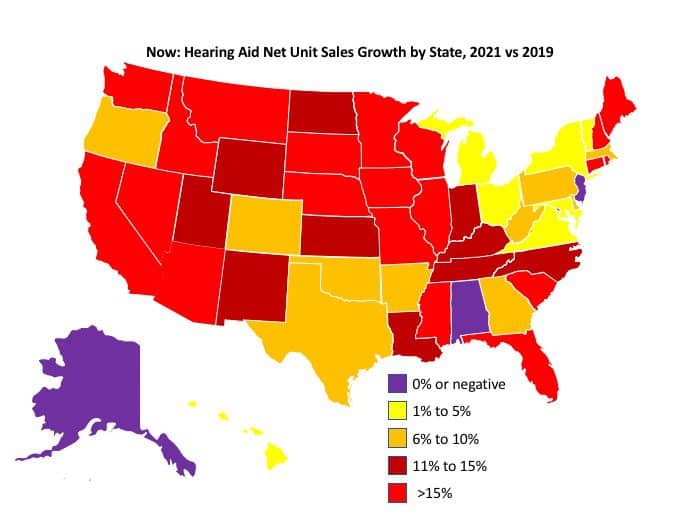

Almost all states experienced hearing aid sales decreases due to the pandemic (Figure 4a), so it’s probably no surprise that those states which fared best in 2020 continued to do better in 2021 relative to the pre-pandemic sales figures of 2019 (Figure 4b). In general, the Southwest, Pacific Northwest, and North Central states experienced unit sales increases of 10-15% or more, while much of the Great Lakes (east of Wisconsin and Indiana), Mid-Atlantic, and South Central states saw sales increases of less than 10% (see Figure 4b).

Most northern New England states experienced exceptional recoveries with increases of 10-15%+, as did the Southeastern portion of the country, with the exceptions of Alabama and Georgia.

The three giant hearing aid dispensing states of California, Florida, and Texas—which constitute almost one-third of the entire US market—saw their 2021 sales increase by 17.3%, 15.1%, and 9.5% above 2019 levels, respectively.

It should be noted that HIA state-by-state statistics for 2021 included an large number of unallocated units (close to 4% of total sales), so some caution should be used when considering these figures.

Styles of Hearing Aids Dispensed in 2022

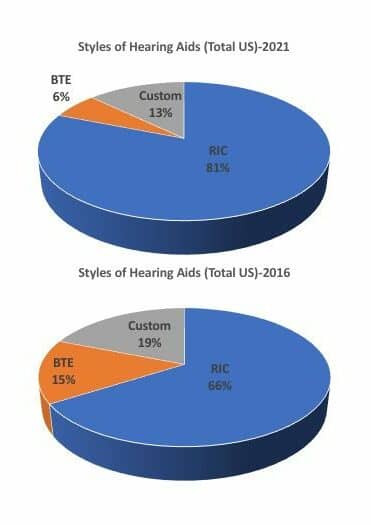

As explained in the article “A Brief History of Hearing Aid Styles, 1991-2020”, receiver-in-the-canal (RIC) hearing aids continue to overtake the market, and they now constitute 81% of all US hearing aids sold, up from 66% only 5 years ago (Figure 5). Considering this growth and that many of the future OTC hearing aids introduced later this year will utilize this form factor, the relatively new RIC style (introduced commercially on a widespread scale in 2003) can be considered a true disruptive technology. Traditional behind-the-ear (BTE) hearing aids made up 6% and custom ITEs made up 13% of US hearing aid units sold in 2021.

Hearing Aid Returns for Credit

The overall return-for-credit (RFC) rate in 2021 was 15.3%, with 16.9% of all hearing aids being returned in the private/commercial market and 6.6% in the VA. RICs had an overall RFC rate of 14.1% (15.7% private/comm; 5.0% VA). Traditional BTEs had an overall RFC rate of 13.6% (14.1% % private/comm; 9.6% VA), and the custom hearing aid RFC rate was 22.4% (25.6% private/comm; 11.6% VA).

Summary

The US hearing aid market rebounded from a net unit loss of 18% in 2020, which was induced by the pandemic, to an increase of 37% in 2021—essentially making what would appear to be a full recovery. In fact, hearing aid sales in 2021 ended up an impressive 12% above pre-pandemic 2019 levels. Pent-up demand is likely to keep fueling hearing aid market growth numbers in 2022 for both the private/commercial market and especially the VA.

It would certainly be nice if we could just leave 2020 behind, as well as any of the problems the pandemic causes in the hearing care of seniors, who are at the greatest risk for Covid-19. As noted in last year’s analysis of hearing aid sales, there is evidence the hearing industry is more resistant to recessions than most other industries; however, it turns out that the industry is also uniquely vulnerable to pandemics or anything else that would dissuade older adults from venturing from their homes (eg, extended weather events, etc). The danger of future strains of the virus to older adults—counter-balanced by “Covid fatigue” or a resigned attitude that this may be our “new normal”—will be a greater determinant of 2022 hearing aid sales than any other disruptive issue, including the introduction of OTC devices this fall or even Medicare provisions for hearing aids, at least in the short term.

Barring an uptick in Covid-19, stock market upheaval, recession, military conflicts with Russia or China, political turmoil during the mid-term elections, or some other unforeseen adverse event, it’s reasonable to expect that 2022 hearing aid market growth will be higher than the more recent historical norms of around 3-5%. Hearing Review predicts an overall 5-7% increase in units sold, with better sales in the first-half of the year, and year-end sales exceeding 5 million units.

About the author: Karl Strom is the editor-in-chief of The Hearing Review and has been reporting on hearing healthcare issues for over 25 years.