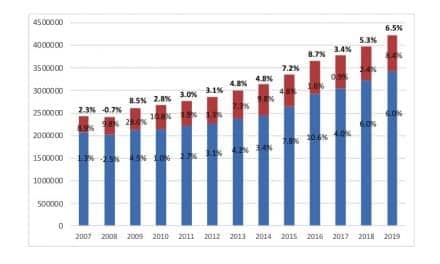

Although not quite approaching the double-digit (11.3%) sales increase of the first quarter, second-quarter US net hearing aid unit volume increased by 6.5% compared to the same period last year, according to statistics generated by the Hearing Industries Association (HIA), Washington, DC. When combined, hearing aid unit sales in the first half increased by 8.8% (Figure 1). The last time unit increases approached this level was 2006. Sales growth was evenly divided between the private/commercial sector (8.8% increase) and dispensing activity at the Department of Veterans Affairs (VA, 9.0% increase).

[Click on figure to enlarge.] Figure 1. US quarterly net unit sales of hearing aids (2007-2014), with the private/commercial market shown in blue, and the VA shown in red. Overall yearly sales percentage gains/losses are displayed at the top of the graph, with percentages of VA and private/commercial market gains/losses shown in the middle and bottom, respectively. Source: HIA. *Through first half of 2015.

For the private sector, behind-the-ear (BTE) hearing aids made up a full four-fifths (80.0%) of all unit sales, compared to just over three-quarters (76.9%) during the same period last year. For the total market, first-half BTE sales constituted 78.9% of all sales compared to 77.1% of sales in 2014. Hearing aids containing wireless technology made up 87.0% of the US market in the first half, up from 80.8% during the first half of 2014.

Source: HIA

Karl: Would you please address how/why the HIA numbers and the DATA WATCH (by Sikka) numbers differ…and why?

Many thanks. —Doug

Hi Doug: Sikka and Alitta Boechler would be better able to answer this. My only guess is the population of Sikka software users (I’m guessing more smaller to medium size practices?) versus the entire universe of the HIA private-sector which includes large/small practices, big box retail, and essentially everything that isn’t the VA (except some notable non-reporting companies like Interton, GHI, and Sebotek). Some of the charts in Boechler’s 2.25 years of data paint a rather gloomy picture. I think it’s obvious that Costco and some other retail avenues are inflating HIA private sector numbers; how much is never easy to tell until you hear more specific figures from reliable sources. But, as I said in this article, it’s hard to believe that all of this growth is just Costco et al. Would you agree? Link: https://hearingreview.com/2015/06/sales-trends-hearing-care-practices-2013-2015

Hi Doug,

I think Karl is correct. Sikka Software collects data from a subset of Audiology clinics, specially private practices.

We did see an uptick in hearing aid sales in 2014, but I think it is too early to tell for 2015. When we published the article we only had data from the through April and Sikka recorded the largest volume in sales mid to late 2014.

Thank you,

Alitta Boechler

Instead of looking at the type of instruments, it would be interesting to see what levels (economy, entry, mid level, premium) have increased or decreased. If the Costco mentality of selling low priced instruments prevails, manufacturers might see their high tech R&D instruments fail to take off as more “customers” go for price over quality.

Hi Gran: Brian Taylor recently wrote an intriguing article about the “good enough” era of hearing healthcare products. You can read it at: https://hearingreview.com/2015/04/blog-good-enough-era-hearing-healthcare/

Speaking from the perspective of someone who has tried to craft dispenser surveys gauging the level of dispensing at 3-4 price point/technology levels, it’s very difficult to get an accurate “handle” on this picture. Invariably, when compared to what the major manufacturers candidly tell me, it would appear that dispensing professionals invariably over-estimate the percentage of premium aids dispensed, while mid-level is in the ballpark, and economy level aids are grossly under-estimated. It’s a multifaceted problem, because, in reality, there are probably 4-6 (or more) price/technology levels that dispensers and manufacturers variously use, and that yields toward more inaccurate surveys (i.e., what defines [in price or technology] one level of aid from another)?

But I agree with you: getting an accurate unit count of even a “good, better, best” hearing aid volume might reveal a lot about what is going on in our market.

Great news but not totally unexpected and was predicted by Freeman and Windmill in their articles and presentations on workforce needs in recent years. They recognized the average age a person first acquires hearing aids in the U.S. is age 69. The baby boomers first began to hit this age in January 2015 and it’s probable this is influencing market growth. So, while big box and technological improvements may contribute to hearing aid sales, let’s also recognize the baby-boomers have finally arrived.

“let’s also recognize the baby-boomers have finally arrived.” – Excellent point Barry.

I agree: that IS a great point, Barry. We had a lot of up-and-down years (and quarters) in the 1990s and 2000s that were not always easily correlated to the economy or any other apparent factor. (Back then, I think Carole Rogin said something to the effect that the economy isn’t a great barometer of the hearing industry but the hearing industry appears to be something of a barometer for the economy.) Quite a while ago, one of the market analysts (Niels Leth or Michael Clemons?) pointed out there was also an intriguing dip in sales in the late-90s that appeared to coincide with an intriguing dip in the population of 65-70 year olds. But, at any rate, we’ve talked about Baby Boomers entering the market for a long time. Inevitably, they have to start making an impact.