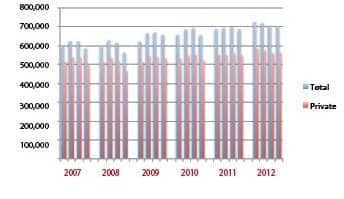

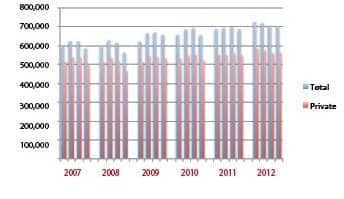

A net total of 2,852,535 hearing aids were dispensed in the United States during 2012, for an increase of 2.9% over the previous year, according to statistics released today by the Hearing Industries Association (HIA), Washington, DC. Private sector (non-VA) unit sales rose by 2.8% in 2012, while Veterans Administration dispensing activity increased by 3.2%. The VA now constitutes 20.2% of the entire US hearing aid market.

The fourth quarter of 2012 saw only modest sales growth, with a 2.4% increase over the same period last year. Private sector dispensers experienced a sales increase of 2.5%, while the VA saw slightly lower unit volume growth (2.2%). As noted in the November 2012 HR Staff Standpoint, dispensing activity in the third quarter was relatively flat (1% increase over 2011), and a relatively soft fourth quarter was expected—particularly in light of the uncertainty surrounding the US elections, the world economy, and the divisive “fiscal cliff” negotiations taking place in Congress. Although it’s true that the overall 2.9% unit increase places 2012 sales on the lower end of the industry’s historic 3% to 4% sales growth average, when placed in perspective these numbers can be thought of as “not great, but not terrible.”

Behind-the-ear (BTE) hearing aids constituted 70.7% of the entire US market in 2012, which was about the same as 2011 (69.9%). However, BTEs with external receivers (eg, RICs and RITEs) continued to consume a larger portion of market share. These aids represented 64.6% of all BTEs—or almost half (45.6%) of all hearing aids sold in the US during 2012. In 2011, they represented only about half (49.3%) of all BTEs and one-third (34.4%) of the entire market.

In general, industry analysts are predicting more of the same during the first two quarters of 2013, with a possible pick-up in sales during the second half of the year. Of increasing interest is if the new lineup of premium hearing instruments introduced last fall at the German EUHA Congress, as well as those that will be introduced in the first half of this year, will positively influence average sales prices which have been decreasing by 1-2% in the last couple of years (see January 2013 Staff Standpoint).