![[Click on image to enlarge.] Quarterly US net unit hearing aid sales for the private/commercial (blue) and VA (red), with year-on-year percentages for each (and overall sales in bold at the top).](https://hearingreview.com/wp-content/uploads/2017/07/HIAQtlySales_H1_2017-300x225.jpg)

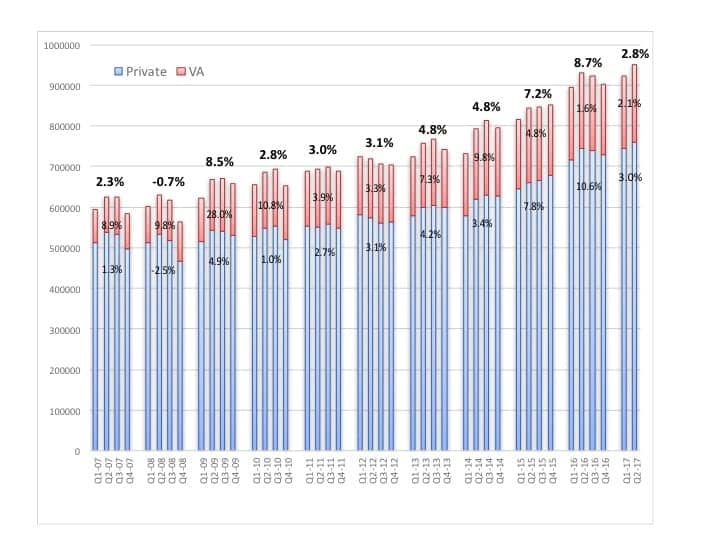

[Click on image to enlarge.] Quarterly US net unit hearing aid sales for the private/commercial (blue) and VA (red) markets, with year-on-year percentages for each and overall sales increases in bold at the top. Source: HIA.

When looking at the private/commercial (non-VA) market, hearing aid unit sales increased by 3.9% and 2.1% in Q1 and Q2, respectively, for a total of 3.0% for the first half of 2017. VA hearing aid units increased by 1.3% and 2.8% during the first two quarters, for a total increase of 2.1% in H1. The VA constituted 19.8% of all US unit sales in the first half.

BTEs made up 82.1% of all hearing aids dispensed in the United States during the first half, with RIC/RITE styles (a subcategory of BTEs) constituting about two-thirds (68.5%) of all sales. When looking at only the private sector, BTEs made up 83.1%, and RIC/RITEs 68.8% of all hearing aids sold.

So, to what can we attribute the robust HIA-reported unit sales increases during the past 4 years? Here are five factors to keep in mind:

- The most obvious one is the continued aging of the US population—particularly the Baby Boomers. According to the US Bureau of the Census, during the 8 years from 2012 to 2020, the age 65+ population will increase by 12.82 million people—from 43.14 to 55.97 million—or by 29.7%. According to the NIDCD, nearly 25% of those ages 65-74 and 50% of those ages 75+ have a disabling hearing loss. Increasingly, hearing aids offer an array of wireless connectivity and accessory options, making them more attractive, particularly to Baby Boomers. A total of 88.8% of all hearing aids sold in H1 featured wireless functionality, according to the HIA statistics.

- The VA continued to see its hearing aid units increase by 7.3% and 9.8% in 2013 and 2014, respectively, bolstering overall hearing aid sales. Then, in 2015 and 2016, VA dispensing tailed off (4.2% and 3.4% growth) while private-sector unit sales increased by a prodigious 7.8% and 10.6%, respectively.

- Intricon, a substantial manufacturer of hearing aids and supplier for UnitedHealth and many others, started reporting unit sales to HIA in Q1 2016, probably accounting for a 2-3 percentage-point boost in sales last year. Similarly, Hansaton started reporting its hearing aid sales at the same time, further contributing to the 2016 HIA-reported unit increase.

- Costco and other Big Box retailers have continued to make a sizable impact on private/commercial-sector sales. Hearing Review estimates Costco’s current market share at around 12%, with a 2016 growth rate in the high single-digits. Although unit volume statistics are not available for WalMart and Sam’s Club, it would appear they have grown during the past 4 years, as well. Big Box and mass retailer sales should continue to grow. CVS Pharmacy has added audiologist-staffed hearing centers within 7 of its store locations in the Baltimore-Washington, DC, area with plans to expand to a total of 50 locations by the end of this year.

- Due at least in part to the continued success of Costco and other chain retailers, as well as competitive pressure from PSAPs and hearables, average sales prices (ASPs) have moved downward, making hearing aids more affordable—particularly in the economy lines. Hearing Review reported an 11.6% CPI-adjusted price decrease in economy hearing aids from 2013 to 2016, while mid- and economy lines held more steady. In that same 2016 survey, 93% of practices offered at least one hearing aid for less than $1500, 41% offered a device for less than $900, and 21% for less than $500.

Thus, a return to historical norms in unit growth during the first part of 2017 might be at least somewhat explained by the 2-4 percentage points from Intricon and Hansaton last year, a relative slowdown in VA unit growth, and possibly a maturing mass retail segment. Although the economy appears to be strong (the stock market is in record territory), political turmoil and the tug-of-war over repealing and/or replacing the Affordable Care Act (ACA, or Obamacare) could also conceivably have an impact on older adults, causing them to guard their wallets more closely. Recent media and legislative attention regarding OTC hearing devices could also be prompting seniors to take a wait-and-see posture when considering the purchase of hearing aids. — KES

How many people currently rely on caption phones in the US?

How many caption phones are sold in the US each year?

Hearing aid sales have become a commodity and sales are up. However hearing health care has decreased because of this. So many companies selling the product want to simply eliminate the audiologist.

So I predict that as time goes by we will begin to see an increase in ontological disease as well as other disease that a thorough audiological test battery could have identified.

Very sad for the patient.