Blog Page | February 2014 HR

The following is adapted from two of Holly Hosford-Dunn’s articles (January 7 and 14, 2014) in her Hearing Economics blog at HearingHealthMatters.org. — David Kirkwood, HHM Editor

Raising the Curtain on Wholesale-to-Retail Hearing Aid Pricing: The Myth of the 5x Markup

By Holly Hosford-Dunn, PhD

Are hearing aid markups as high as Internet operators and others claim? Are dispensing professionals routinely using a “5x markup?”

How High Did You Say?

Based on the 89,400 results accrued from a simple Google search of “$6,000 hearing aids,” it seems reasonable to use the decade-old anchor price of $6,000 for a set of instruments as the worldwide retail benchmark.

Anchor price is not Price, but it is what comes to people’s minds, true or not. In reality, prices vary widely depending on device, provider, location, and competition. Anchoring is important because it reflects an almost unavoidable cognitive bias to make decisions around the anchor price, whether it’s real or not.

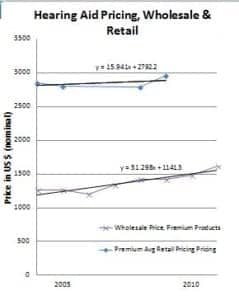

A quick look at Figure 1 disproves the anchor price for hearing aids in general. The retail data are not new or particularly hard to find. They were published years ago in The Hearing Review and Hearing Journal, and made available in the Phonak Survey Report, published in HR. Hearing Economics combined the data from these sources, along with references in two blogs from last year. On average in the United States since 2004, retail prices for a binaural set of hearing aids were $3,400-$4,200. I say “disproves,” but this is actually part and parcel of the anchor bias: if a consumer has $6,000 as his/her anchor price, then $4,200 seems like a bargain. Plus, premium hearing aid pricing approaches the anchor price.

Internet operators know about anchor bias—which is why they set the $6,000/pair anchor as a deliberate starting point and then “negotiate” price downward by offering those $399/ear offers. That’s the extreme, but what about dispensing professionals who sell and fit hearing aids? Do they benefit from the anchor price bias as well?

Retail Pricing

We know from a previous post that hearing aid premium wholesale and average retail price tracked inflation closely, as reflected in the parallel functions of Figure 1, which is based on HR and HJ survey data. Figure 1 further shows an average retail price increase of $45/year over the last decade. That’s a bit less than the $51/year increase in wholesale prices of premium products shown in the figure, and about double the $24/year increase in average wholesale pricing.

For the sake of argument, let’s make the broad assumption that licensed retailers attend carefully to their Cost of Goods and therefore face the wholesale costs shown in Figure 1. To the extent this assumption holds, then product and service markup ranged from $1,300 to $1,500 per hearing aid. That’s a “markup” of 2.5 to 2.9—substantial, certainly, but even if costs of doing business are not accounted for, it’s still far below the 5x markup claimed by Internet sellers. Gross profit margins (100 x [Retail–Wholesale]/Retail) stayed steady at 70% to 75%.

More Myth Busting

- Hearing aids act like other consumables in the fabled economic basket of goods. Their pricing at the wholesale and retail levels reflects inflation. Only that and nothing more.

- The anchor price of $6,000 per pair is a fable when it comes to an average hearing aid purchase, which means that the majority of consumers experience varying degrees of bargain perception when they purchase instruments—especially if the dispensing professional “sets” the anchor early when discussing price.

- Licensed retailers realize the same percent gross profit margin year after year. It falls well below the fabled 5x markup claimed by Internet competitors.

Now What?

What Figure 1 does not provide is average retail price of premium instruments, which is crucial to the discussion because that’s where most of the wholesale increase is occurring. The big questions are: How much of the higher cost of premium goods is being passed on to consumers and to which consumers?

These two questions are the subject of the next blog post, which can be accessed in the online version of this article at http://hr.alliedmedia360.com or http://hearinghealthmatters.org/hearing economics.

Holly Hosford-Dunn, PhD, is an audiologist and founding partner and editor of hearinghealthmatters.org. She has developed multi-office private practices in Arizona, authored several textbooks, and is now pursuing a degree in economics.

Original citation for this article: Hosford-Dunn, H. Raising the curtain on wholesale-to-retail hearing aid pricing: the myth of the 5x markup. Hearing Review. 2014, February: 10.