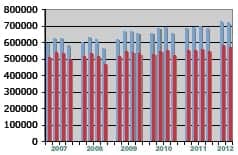

According to statistics compiled by the Hearing Industries Association (HIA), Washington, DC, US net unit sales of hearing aids increased by 2.88% in the second quarter of 2012 compared to the same period last year (blue bars in figure), with sales from the private (non-government) sector topping 3% (red bars). When added into the 5.31% gains in Q1, total US hearing aid sales improved by 4.08% over 2011 first-half sales.

Unlike previous years, a slowing of dispensing activity at the Department of Veterans Affairs (VA)—which now accounts for one-fifth (20%) of all hearing aids dispensed in the United States—slightly blunted total industry growth. The VA experienced a 1.97% increase in units dispensed during Q2, following a 4.82% increase in Q1. Thus, in a turn-around that has been anticipated for awhile by both the VA and the hearing industry, private-sector sales growth is now beginning to equal or outpace that of the agency. Private sector sales saw increases of 5.43% and 3.11% in the first two quarters, for a 4.27% increase in the first half (compared to the same periods in 2011). Since the second quarter of 2011, VA dispensing activity has started to level off from very strong (often double-digit) growth during the past decade due to the wars in Iraq and Afghanistan, the aging population, and an easing of eligibility requirements at the agency.

BTEs constituted 70.13% of the industry’s total sales during the first half (70.94% of private sector and 66.87% of VA sales), which is essentially the same as 2011 year-end statistics. About two-thirds (64%) of those BTEs featured external receivers, suggesting that RIC/RITE-type devices now make up about 45% of all devices dispensed. Returns for credit were between 19% and 20% for Q1 and Q2, which are roughly the same as 2011 statistics.

The latest HIA market statistics show an industry that has now posted positive sales figures for 6 consecutive quarters and, like the general economy, continues to show modest growth. Some analysts and industry experts have worried that a softening in average sales prices (ASPs) is cutting into overall industry revenue growth; however, they also point out that we are now in a unique period when many of the major manufacturers’ premium product lines are reaching the end of their life cycles. The introduction of several new premium products to be announced at the IHS, ADA, and German EUHA Conventions should help bolster these ASPs in the near-future.

Karl Strom

Editor-in-Chief