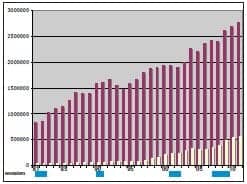

Net unit hearing aid sales in the United States increased by 3.0% overall in 2011, with private sector and Veterans Administration (VA) dispensing activity increasing by 2.7% and 3.9%, respectively, according to year-end statistics compiled by the Hearing Industries Association (HIA), Washington, DC. This comes on top of a 2.8% overall unit volume increase in 2010 and an 8.5% increase in 2009 (Figure 1).

Utilization of behind-the-ear (BTE) hearing aids by dispensing professionals continues to increase. BTEs comprised 69.9% of all the hearing aids dispensed in 2011 (70.8% private sector; 66.4% VA). This compares to 66.9% in 2010 and 64.1% in 2009.

The VA now constitutes one-fifth (20.2%) of the hearing aid market. For two years (Q2 2008 to Q2 2010), the VA experienced quarterly unit increases ranging from 9% to 32% due to the loosening of eligibility requirements of veterans and family members, as well as hearing- and tinnitus-related injuries from the two wars. However, by the middle of last year, the VA had worked through most of its backlog of patients. Thus, in 2011, the VA’s sales more closely paralleled those of the private sector.

Figure 1. US hearing aid sales (in net units, private sector + VA) from 1981 to 2011. Total sales are shown in magenta, and VA sales are shown in yellow. Recessionary periods are denoted by the blue bars underneath the years (x-axis)

What does it all mean? While a 3% market uptick in 2011 sales isn’t exactly a cue to don our party hats and start dancing in the streets, it’s also not bad given the backdrop of the yo-yo movements of Wall Street and the white-knuckle uncertainties of the domestic and European banking/credit situation. Most hearing industry market analysts forecast the average 2% to 4% sales growth for 2012, and HR believes it could be substantially higher given a stabilized economy. For you political junkies out there, 5 of the past 8 years that featured presidential contests (1980 to 2008) saw hearing aid sales increases of more than 3%. Now that should make the Trivia Bowl.

In recent months, I’ve read and disagreed with a couple of arguments about how the hearing industry isn’t actually as recession-proof as some people have made it out to be (for a rebuttal, see my column, “Are We Recession Proof?“). One counterpoint to the “recession-proof argument” is that unit sales don’t always tell the entire story; indeed, average sales prices (ASPs) have appeared to flatten or decline slightly in several markets. But prices certainly have not plummeted, and volume increases have largely buffered these changes. The fact is that we are now emerging (hopefully) from the Great Recession, and annual US net unit hearing aid sales changed by -0.73%, 8.5%, 2.8%, and 3.0% in the four affected years from 2008 to 2011. Ah, but what happens when you ignore those huge VA sales gains? Private sector sales changes were -2.5%, 4.9%, 1.0%, and 2.7%—again, not stellar, but still rather illustrative of our market’s resilience.

Are we recession proof? Of course not. I’ve spoken to numerous dispensing practice owners who say the past few years were not kind to them, so demographics and positioning obviously play large roles in any results. HIA statistics during the last economic downturn (2001-2002) indicate that overall US hearing aid sales decreased 0.1% and 1.3% in those respective years. But it would certainly appear that we are at least recession-resistant and that outside forces—particularly FDA/FCC interference during the early 80s and 90s—have played much larger roles in influencing our industry’s growth than the vacillating economy.

Karl Strom,

Editor-In-Chief