In the last 5 years, we’ve seen a lot of technological change. But will it translate into greater customer satisfaction and accelerated market growth?

George S. Kaufman, the legendary humorist and playwright who cowrote several of the Marx Brothers’ best films, had attended a farewell party in Hollywood for a fellow playwright who was moving to New York City. About a week later, Kaufman bumped into this same playwright who had decided to delay his trip in order to work on another project. Kaufman greeted him saying, “Ah, forgotten but not gone.”

One feels the same sentiments about 2007 and the first quarter of 2008. The hearing care field continues to see a large amount of innovation and change relative to technology, but sales during the last year have been relatively flat. The race between hearing aid manufacturers’ research and development (R&D) departments sometimes resembles the Cold War arms race: amazing levels of sophistication and features being added to devices, only to be topped by another device 9 months later. This becomes more evident when looking at product life cycles. Although there are some very successful hearing aid product lines that have remained viable for several years (usually upper-end products that undergo frequent updates), the effective lifespan in some market segments is as little as 9 to 18 months. This amount of time is about one-fourth of the average witnessed in the mid 90s.

Unfortunately, the swift pace of technological change did not ignite sales in 2007. According to Hearing Industries Association (HIA) statistics, hearing aids dispensed in the United States during 2007 totaled 2.42 million units, an overall increase of 2.3%. Similarly, private sector sales (ie, nongovernment dispensing activity that excludes the Veterans Administration) of hearing aid units increased by 1.3%. Although that sounds like pretty flat sales, it should be remembered that this followed a 7.7% increase in sales in 2006—the industry’s largest year-on-year increase in a decade.

Initial indications are that 2008 will be a better year for sales than 2007—as long as the nation’s economic downturn doesn’t cast a pall on the spending habits of seniors. If it does, as Kaufman might say, 2007 will be forgotten but not gone.

The following is offered as a look at the top-10 trends that are influencing, or will influence, the hearing industry. As with any list of this kind, there are many items that are left out due to space constraints, and more trends are included in the online version of this article.

10 Trends Transforming Hearing Aid Dispensing

The mini-BTE and new-generation form factors. There can be little argument that mini-BTEs have revolutionized the hearing instrument market, as over half (51%) of all hearing aids dispensed in the United States during 2007 were BTEs.

A decade ago, in 1997, BTE market penetration was only 18.8%. Use of BTEs rose slowly but consistently in the ensuing half-dozen years, probably due to the effectiveness of directional fittings in BTEs and the evolution of new transparent tubing and earmold options that helped close the gap in the cosmetic advantage that ITEs enjoyed. After the introduction in 2003 of the ReSound Air, an open-fit mini-BTE, and the Sebotek PAC, a deep-fitting RIC, the use of BTEs accelerated rapidly. Last year, BTEs constituted 51.4% of the overall US market (53.3% of the private sector), and most manufacturers offer at least one open mini-BTE and/or RIC model.The Hearing Review (HR) projects BTEs will make up 56% of the total market in 2008.

When boiled down to basics, both open-fit and RIC BTEs use concepts that have been around for years, but implement them in novel ways within a digital framework and other product innovations. Expect more of these form factor innovations in the future. As only two examples (this article was written prior to the official American Academy of Audiology convention product launches), Phonak has introduced an open-fit CIC that uses digital shell-modifying technology to optimize venting, and ReSound has introduced its Be hearing instrument that is a BTE-ITE hybrid.

Wireless is ready, but are we? We hear with our brains, which receive acoustic (neural) data from both ears, so it makes sense that it would be beneficial for both ears to share information in real time. Likewise, as anyone knows who has muttered the words, “Get off your stupid cell phone and drive,” today’s modern citizen is in constant contact with the world of their own electronic choosing.

For these reasons HR has for years been predicting a new class of hearing instruments that would use wireless signals for integrating binaural (eg, localization) cues, while connecting people to external microphones, cell phones, MP3 players, and personal digital assistants, as well as other peripherals like TVs and stereos.

Today, at least four manufacturers have product lines that incorporate wireless binaural and communications with external devices. Although most of these systems have proven to be exceptionally useful as communication tools, the initial problem has been in getting the wireless/Bluetooth communication components (that drive the peripheral devices) to be widely embraced by dispensing professionals. In some cases, manufacturers have retreated from making the wireless system the leading feature of the device to making it a “supporting-cast” member—a disappointment for the developers who spent years working on the systems.

Although there may be some well-founded criticism that questions the need for wireless features for a core audience of seniors (age 65+), the wider application of wireless in hearing aids and their appeal to both older and younger hearing aid wearers is difficult to debate.

The problem may boil down to professional and consumer education. A panel led by Arthur Boothroyd, PhD, authored an article in the June 2007 HR that, in part, recommended: 1) Creation of reasonable expectations for hearing aids that do not have a wireless microphone, and tailoring hearing devices to suit patient needs; 2) Enhanced patient counseling and practitioner training on wireless microphones; 3) Getting wireless transmitters and receivers into every public place and every hearing aid, respectively; and 4) Encouraging across-platform listening systems so as to avoid the confusion and reduce the expense of these systems.

There is little question that wireless will prove to be a big boon to hearing health care, and it may even prove vital for the ultimate survival of private practice dispensing.

Broadband in testing and fitting. Since writing his doctoral thesis on the subject in 1979, Etymotic Research founder Mead Killion has maintained that higher fidelity acoustic cues—out to 8-12 kHz—promote intelligibility, and that hearing-impaired listeners are surprisingly good judges of fidelity. (He also wrote a series of popular articles in 2004 that address this subject and are available in the HR Archives.) In fact, Killion insists that the success of the K-Amp was, in part, related to fidelity issues.

Hearing instrument fitting in the extended high frequencies—and true high-fidelity hearing aids—are becoming more common as the major hearing instrument suppliers have brought to market new high-fidelity receivers and transducers, making hi-fi hearing a hotly contested marketing area between the suppliers.

The move to broader bandwidth may have payoffs other than hi-fi sound quality for adult listeners. For example, researchers led by Patricia Stelmachowicz, PhD, at Boys Town National Research Hospital have concluded that a restricted listening bandwidth (below 6-7 kHz) can negatively affect children’s perception of /s/ and /z/ sounds when spoken by female talkers like mothers and other female caregivers.

If high-frequency sound production in hearing aids really does become a goal, then high-frequency hearing aid testing and fitting, using equipment like supraural headphones and extended fitting targets, might not be far behind. Some unintended consequences of the broadband movement might be earlier detection of hearing loss and enhanced tinnitus management capabilities.

Evidence-based practices. The use of evidence-based principles (EBP) has gained wide support in the last 3 years. EBP relies on science and the discernment of levels of evidence to drive clinical office/practice decisions.

As J. Gail Neely, MD, pointed out during a presentation on EBP at an American Auditory Society meeting in 2000, progressive scholarship requires that professionals understand EBP concepts and hone their ability to assess levels of evidence in any particular study; recognize that some things learned in professional education are either obsolete or later found to be completely wrong; acknowledge that continuing education seminars, while useful, are not especially effective in changing practice procedures; and realize that the offices/practices that do not adhere to progressive scholarship are doomed to fall behind. In other words, you have to be an avid reader and rigorously maintain your skepticism, while keeping an open and discerning mind about things that might improve your client care.

EBP swings both ways: it challenges dispensing professionals to craft their businesses/clinical practices according to evidence-based principles, and it challenges researchers and product developers to share with them the mutual goal of improved patient care based on the strongest scientific evidence available.

Ruth Bentler, PhD, and colleagues wrote an article in the June 2007 HR that explains EBP and recommends: 1) More funding and collaboration, as well as pooling of research data in hearing care; 2) Sharing clinical data in formats that dispensing professionals can easily assess, interpret, and use; and 3) Implement EBP as a vital part of our clinical culture, including the evaluation of outcomes when using EBP.

As Kochkin has pointed out in MarkeTrak VI (February 2003 HR), it’s even possible that a Best Practices Guideline—the equivalent of an ISO 9002 program that optimizes benefit for the customer at the point of sale—emerges from EBP. Much of our technology is not being fully customized to meet the unique hearing needs of consumers. The use of EBP in a Best Practices Guideline might provide greater benefit, customer satisfaction, and market growth.

Trainable hearing aids. Want an indication of just how fast hearing innovation is moving? In the April 2007 edition of HR, the National Acoustic Laboratories’ Gitte Keidser, Elizabeth Convery, and Harvey Dillon reported on a hypothetical “trainable” or “self-adjustable” hearing aid that would present a wearer with a set of control buttons used to manually adjust hearing aid parameters to reach their preferred gain and frequency responses in various listening situations. The authors envisioned patients taking the device into typical, daily listening environments and adjusting the device as needed, with the hearing aid keeping track of their changes. When the hearing aid had enough data, it would begin to make predictions itself, with the user refining the computer settings, when necessary. The device would be considered “fully trained,” the authors note, when the hearing aid would be able to accurately predict all the user’s preferences.

Science fiction? Not really. Six months later, in the October 2007 HR, Dijkstra and colleagues reported on how Bayesian probability theory is being implemented in hearing aid algorithms to solve hearing aid fitting problems. The authors show why probability theory will play a large role in future generations of hearing aids and hearing fitting software. Using classic cases of deductive and inductive reasoning as initial examples, they show how probability theory can collect a large base of knowledge, then use newly acquired information “on the fly” to adjust all those interacting fitting parameters in ways that should lead to enhanced patient satisfaction.

Granted, it’s not exactly the system Keidser et al proposed, but it’s probably a close cousin to theirs. And even if you couldn’t give a hoot about the inner workings of computer learning systems, it’s easy to see how trainable hearing aids could transform the industry. Plus, gaining the ability to insert the phrase “Bayesian probability theory” (as if to distinguish it from all those other dreadful probability theories) into a party conversation is boorishly priceless.

Digital earmolds and e-customization. On the one hand, we have an industry that is experiencing a revolution in the BTE market, a fair portion of which is related to noncustom earmolds. But, largely overlooked, the ITE custom earmold portion of the market is also experiencing a revolution.

The digital earshell revolution is opening up a new world of options and efficiencies for dispensing professionals and manufacturers. Started only about 6 years ago, manufacturer-scanned impressions allow for a laundry list of benefits, as detailed in the February and March 2008 editions of HR by Roy Sullivan, PhD. As in-office scanning becomes more routine, the custom earmold will become far more scientific and precise, and manufacturers are already using the technology in digital shell and venting modifications to create new and improved styles of hearing aids.

|

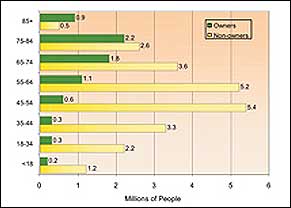

| Figure 1. US hearing loss population in 2004 by age: hearing instrument owners (green bars) versus nonowners who have a significant hearing loss (yellow bars). The vast market opportunity is in getting potential users to wear amplification products earlier. Source: Sergei Kochkin, PhD, Knowles MarkeTrak VII, July 2005 HR. |

Products for younger users. By almost any measure, the hearing industry has a poor record of reaching younger adults who are potential hearing aid users. For example, according to the HR 2006 Dispenser Survey, almost three-quarters (74%) of the Americans fitted with hearing aids in 2006 were at retirement age or older. For people ages 85+ and 75-84, the hearing aid adoption rate is 61% and 44%, respectively. Unfortunately, hearing aid adoption rates decline precipitously as we look at the younger age groups in Figure 1. In fact, MarkeTrak VII (July 2005 HR) indicates that the average hearing aid purchaser is 70 years old, while US Census Bureau data indicates that average life expectancy is 78.

Particularly in view of today’s new open-fit, RIC, and wireless fittings, the hearing care field may have an unprecedented opportunity to get amplification devices into the ears of more people who need them—and 15-20 years earlier in their lives.

Hearing conservation products and assistive devices are two more promising areas where the hearing care field could advance the message that its services are not confined to seniors. Earplugs, musicians’ plugs, and swimplugs demonstrate that our field is genuinely concerned about the health and maintenance of the patient’s entire auditory system—perhaps avoiding a mandatory visit at age 70.

Assistive devices, by contrast, might be seen as a first step for those people who didn’t use earplugs when they attended that rock concert or car race, played in a band, or pushed a lawnmower endlessly around the yard on hot summer afternoons. In particular, TV and stereo listening systems, amplified telephones and accessories, and alerting products represent an ideal bridge to ease people into the hearing help cycle—ultimately leading to earlier and more successful intervention and improved quality of life for the consumer.

Consolidation roadblock. Perhaps the most surprising industry event in 2007 was when an antitrust court in Germany decided that the hearing industry is big enough already. They ruled that Sonova’s planned acquisition of GN’s hearing divisions amounted to an “oligopoly,” a term that Wikipedia defines as “a market form in which a market or industry is dominated by a small number of sellers (oligopolists).” Ironically, many people believe that definition best describes lawyers.

Whatever its merits, the court’s ruling ended what would have been the largest deal in the hearing industry’s history and what would have resulted in its largest company. For the most part, dispensing professionals quietly cheered the news. The merger involved two companies whose brands were well liked and used extensively. Everyone likes choice, and most people were happy with the companies in their present forms.

But the blocked deal isn’t without its downside. Some industry watchers have long speculated that dispensers might still benefit from consolidation, where the six or seven largest hearing instrument manufacturers might be pared to a number closer to four or five. With the decision of the German antitrust court, the opportunities for consolidation among the industry’s largest companies would probably be limited to involvement of its two privately held companies, Starkey Laboratories and Widex—and this seems unlikely due to their ownership and industry presence. The consequence of the blocked merger may indeed yield more product choice; it may also result in a group of smaller companies that become acquisition targets for larger firms outside the hearing industry.

Pharmaceutical and other approaches to hearing loss and hearing loss prevention. It should first be acknowledged that nobody got into hearing health care for the purpose of becoming a vitamin salesperson. And for this reason the idea of offering vitamin, mineral, or antioxidant-based supplements to patients can at first appear as distasteful as … well, chewing on a vitamin or mineral supplement. But there is some evidence that indicates hearing care professionals should consider offering supplements. For example, a University of Michigan study found that a combination of high doses of vitamins A, C, and E and magnesium, taken 1 hour before noise exposure and continued as a once-daily treatment for 5 days, was effective at preventing permanent noise-induced hearing loss. Additionally, a number of antioxidants and inhibitors are becoming available that are designed to reduce the production of free radicals that can cause hearing damage.

Other important ongoing research, of course, involves hair cell restoration and regeneration involving genetics, stem cells, and/or pharmaceutical treatments (see the interview with Edwin Rubel that appears in the July 2004 HR).

There are other unique treatment pathways being explored for hearing loss. As one example, HearingMed hosted a successful pilot study on the use of “cold” medical laser therapy in improving unaided word recognition in hearing-impaired patients, and the data was presented at the American Academy of Audiology convention in April. The company is now providing Institutional Review Board (IRB) approved test sites for an expanded, double-blind, placebo-controlled clinical trial.

The Hearing Aid Tax Credit. In the United States, The Hearing Aid Tax Credit Bill (HR2329 and S1410) would provide a $500 tax break per hearing aid for individuals over age 65 or under 18, renewable every 5 years. What would this legislation do for the hearing care market? The best guess is that a 25% reduction in the price of hearing aids would result in about 15% greater use of the devices.

Virtually every hearing-related organization has endorsed the bill, including AG Bell and the Hearing Loss Association of America. Reintroduced in the US House of Representatives by Reps Carolyn McCarthy (D-NY) and Vern Ehlers (R-Mich) and in the Senate by Sen Norm Coleman (R-Minn), the bills are essentially unchanged from legislation that attracted 112 House and 17 Senate cosponsors in the 109th Congress, which ended in 2006.

Unfortunately, the United States is bogged down in foreign conflicts and mountains of debt, while a presidential campaign rages; it is very unlikely that members of this Congress would take up the bill. But that doesn’t mean it can’t build enough momentum in the 110th Congress to make it a top item for the 111th Congress. Speaking at a recent event held by the tax credit coalition, Rep Nick Lampson (D-Tex), who wears hearing aids, spoke of his own hearing loss and the need to continue to build bipartisan support for the tax credit. Addressing the bill’s largest objection, its cost, he noted that tax incentives like HR2329 can be equated to investing in education and that addressing the problem now will “truly cost us less money in the future.” He pledged to promote the tax credit, saying “there is probably no more important legislation that I can work on in the House of Representatives right now.” Following the event, Rep Lampson became the 75th cosponsor of the legislation.

This bill has a very good chance of passing in 2009-2010 with large implications for all parties involved in hearing care, and it needs more professionals’ support.

Karl E. Strom is the editor-in-chief of The Hearing Review and co-editor of The Insider, the weekly e-newsletter complement to HR, both archived at www.hearingreview.com.

What do you think are the major trends? Send your comments to Karl Strom at .