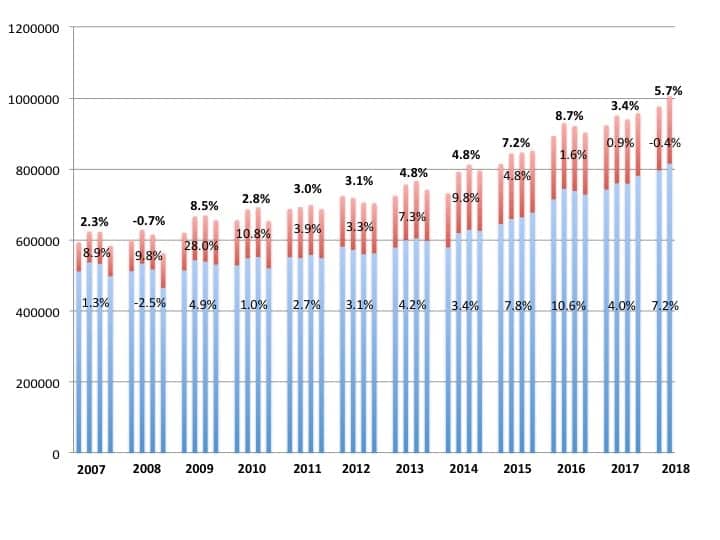

Figure 1. [Click on image to enlarge.] Hearing aid unit sales, 2007-2018. Percentages represent year-on-year increases/decreases in net units for the entire market (top bold), the VA (red), and the private/commercial sector (blue). Source: HIA.

In the second quarter of 2018, quarterly sales of hearing aids exceeded 1 million net units for the first time in the industry’s history, according to statistics generated by the Hearing Industries Association (HIA), Washington, DC. A total of 1,005,141 hearing aids were sold in the United States from April through June (Figure 1), with unit sales increasing by 5.73% compared to the same period last year—the exact same percentage as the first quarter’s sales growth rate.

In 2017, overall hearing aid sales returned to a more typical growth figure of 3.4% after 2 years of higher-than-usual sales in 2015-2016 (7.2% and 8.7% respectively).

When comparing the first half of 2018 to the first half of 2017, private/commercial sector sales increased by 7.24% while dispensing activity at the Department of Veterans Affairs (VA) decreased by -0.43%.

As noted in HR’s previous market reports, HIA statistics have become more opaque for analysis relative to the private/commercial market, which includes traditional dispensing practices. Big box retailers like Costco and Sam’s Club have certainly impacted these figures, with Costco now making up an estimated 12% of the total hearing aid market and growing at what many speculate in the range of 5-8%. IntriCon—another HIA reporting member which manufactures hearing aids for United Health, owns Hearing Help Express (HHE), and provides hearing aids to a wide array of direct-to-consumer (DTC) and other firms— has also been growing rapidly and reported a 30% gain in sales revenues in 2017. Various companies/agencies’ buying cycles also complicate the picture.

All this contributes to making it difficult to understand what might be viewed as “average independent practice” gains, particularly in light of what appear to be continued downward pressure on average sales prices (see the discussion about the results from Hearing Review’s recent dispenser RIC pricing survey).

Karl Strom is editor in chief of The Hearing Review and has been reporting on healthcare issues for 25 years.