Staff Standpoint | February 2014 Hearing Review

By Karl Strom, Editor-in-Chief

Hearing aid unit sales increased by 4.8% in 2013, and behind-the-ear (BTE) hearing aids with external receivers (ie, RICs/RITEs) now make up more than half (52.2%) of all hearing aids sold, according to year-end US statistics from the Hearing Industries Association (HIA), Washington, DC. This year’s sales increase comes on the heels of 2.8%, 3.0%, and 2.9% increases for 2010, 2011, and 2012, respectively. Historically, annual US net unit volume growth has averaged 2% to 4%, so the 4.8% growth figure in 2013 represents a better-than-average year.

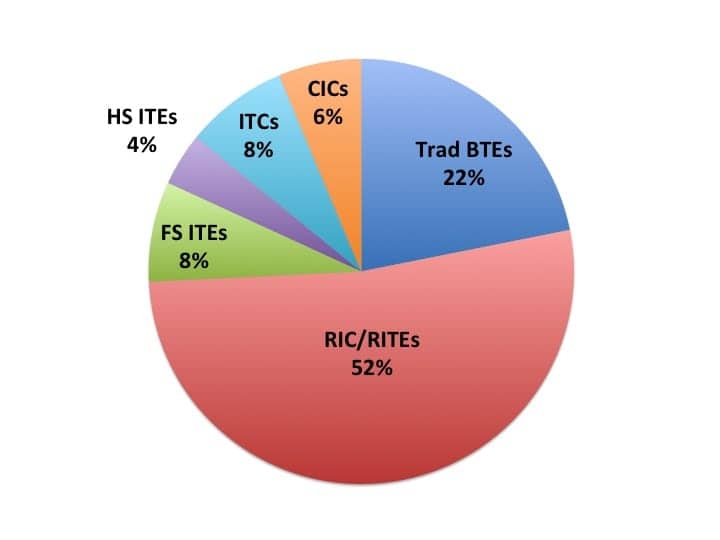

Figure 1.Percentages of hearing aids dispensed by BTE and ITE styles in 2013 (private sector + VA). BTEs constituted three-quarters (74%) of all units dispensed, with 52% of those being RIC/RITE-type devices.

Looking at the entire US market, three-quarters (74.0%) of all hearing aids were BTEs, and half (52.2%) were of the RIC or RITE styles (Figure 1). Traditional BTEs constituted 21.8% of the market. ITEs made up just over one-quarter (26.0%) of all hearing aids dispensed, led by full- and half-shell ITEs (11.6% of total market), ITCs (7.8%), and CICs (6.3%). Three-quarters (74.6%) of all aids dispensed in 2013 featured wireless technology.

The Department of Veterans Affairs (VA) accounted for 20.6% of all units—or 617,000 out of 2.99 million hearing aids—dispensed in the United States during 2013, for a unit growth rate of 7.3% over 2012. When ignoring dispensing activity at the VA, private-sector sales increased by 4.2% over the previous year. On average, private-sector professionals dispensed a higher percentage of RIC/RITEs than VA professionals (54.3% private sector vs 44.1% VA), and lower percentages of traditional BTEs (20.6% vs 26.2%) and ITEs (25.1% vs 29.6%). Over two-thirds (69.6%) of these contained wireless technology, while nearly all (94.0%) VA hearing aids were wireless.

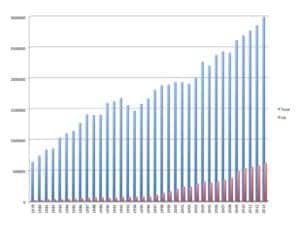

Figure 2.Total US net unit sales (blue bars, private sector + VA) and VA units (red bars) from 1979 to 2013. Hearing aid units in 2013 came very close to topping the 3-million unit mark for the first time in industry history.

Closing in on 3-million unit mark. A total of 2,990,104 net units were dispensed in the US during 2013—tantalizingly close (only 9,896 units short) to the 3-million unit mark (Figure 2). The US hearing industry first hit the 2-million unit mark in 2004. Shortly after this sales landmark, in the February 2005 HR, Starkey Laboratories President Jerry Ruzicka commented: “This second-million mark is an important one, but it took much too long to get here. With the help of President Reagan, the industry topped the million mark in 1983, and together we must all ensure that it is not another 2 decades for the next million.”

So, the good news for the hearing industry is that we cut our time down by a decade to achieve that next million units in sales. How did it happen? The period from 2004 to 2013 has been marked by phenomenal technological growth (notably open-fit and RIC-type aids, feedback and speech-in-noise algorithms, and wireless technology), a lack of FDA/FTC interference, greater professionalism in practices, fewer manufacturers with more resources (and their forward-consolidation into retailing), the emergence of dispensing retail giants (notably Costco), and relatively flat average sales prices (ASPs) and binaural usage rates. The Great Recession aside, the hearing industry has experienced a good—and very competitive—business environment.

Maybe 4 million by 2020? Looking at the big picture and some of the big innovations coming down the R&D pipeline, it’s not impossible.

Original citation for this article: Strom K. Hearing aid sales rise 5% in 2013; Industry closes in on 3M unit mark. Hearing Review. 2014;21(2):6.