Blog Page | September 2015 Hearing Review

The following is Wayne Staab’s July 28, 2015 blog at his Wayne’s World column at HearingHealthMatters.org.

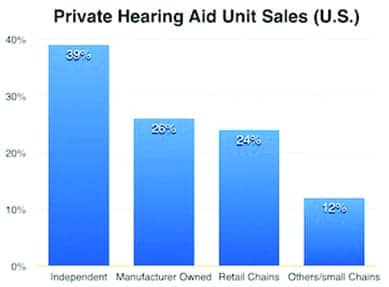

Last week’s post reported on the evolving hearing aid retail landscape, and specifically that of the independent dispenser. Most notably, the emergence of chain retail (such as Costco), the growth of hearing aid manufacturer company owned stores, and the VA has contributed to a 10% decline in independent hearing aid dispensers since 2004, with independents currently selling an estimated 39% of the market unit sales, down from 49% in 2004 (percentage estimates are from Bernstein).1

The Private Hearing Aid Retail Market

It is estimated that the US unit hearing aid market is about 78% private with the balance coming from the Veterans’ Administration.1 The division would be slightly greater in favor of the private market if the wholesale value of the hearing aids sold were considered, rather than looking at unit sales (eg, the VA average selling price [ASP] is much lower than the private market).

Hearing aid private unit sales have been growing at about 3-4% per year,2 but most believe it should be growing at a significantly higher rate if the needs of the hearing impaired are to be fulfilled. But where will the growth occur? If independents are decreasing, surely one of the other groups is taking up the slack. Who is gaining in the private retail market?

Figure 1. US private-sector (non-VA) hearing aid unit sales by distribution channel. Estimates based on Bernstein & Co report and the author.

The private hearing aid market is comprised of (Figure 1):

- Independent hearing aid dispensers (estimated by Bernstein1 at 39% of unit sales). These are businesses with a single office, or a few retail outlets, are owner-operated, and usually run from a store, or from one of the stores if the owner has many. This category also includes small chains of independents such as Sound Point, Hearing Unlimited, Pattillo Balance and Hearing, and others, with other small chains having generally 8 outlets or fewer.

- Hearing aid manufacturer-owned or supplied stores (primarily owned by the “Big 6” below), and estimated at about 25% of unit sales.1 These companies sell their product under GN ReSound (Beltone); Starkey (Audibel); Sonova (Connect Hearing), William Demant (Avada, Hearing Life), and Sivantos/Siemens (HearUSA). Widex does not have branded company-owned offices, and it should be mentioned that some of these chains/networks contain independently owned and operated offices.

- Retail chains collectively estimated at 20% of unit sales.1 These include Amplifon, Costco, store-within-stores, etc.

- Buying groups are not percentage projected because their unit sales are generally included in one of the other hearing aid purchasing categories.

- Direct online/mail order retail, including pure-play Internet retail (Lloyds, Hearing Help Express, etc), mixed Internet retailers (Audicus, America Hears, Hearsource, etc), and referral Internet retailers (require significant interaction with dispensers). No estimate of unit sales is available for these categories.

Projected Directions of Independent Retail Dispensers

Independent hearing aid retailers face pressures similar to other industries:

- Growth of large national chains, or other volume players that use aggressive and innovative marketing strategies to attract consumers to their venue;

- Online purchasing resulting in increased consumer convenience related to product selection, free shipping, and ease of purchasing and returns, and

- Focus on materials experience rather than on personal experience.

Independent retail is projected to continue to decline. Chain retail (store within store) is projected upward, but manufacturer-owned retail is projected to remain at about the same percentage as currently, primarily because many of the small retail chains have already been purchased.

The contribution of small chains to the independent retail market is welcome, but not without a caveat. For example, as small chains grow, they become the purchase target of larger non-independent companies, such as hearing aid manufacturers. Many current hearing aid manufacturer-owned stores resulted from purchases of independents who have used the sale of their practice as part of an exit/retirement strategy.

The growth of independent dispensers is on the decline, regardless of discipline of ownership (audiologist or hearing aid dispenser), and shows no evidence of reversing the trend. Because of their small scale, independent hearing aid dispensers have less bargaining power with manufacturers and, as a result, find it difficult to negotiate large discounts. Average selling price (ASP) is highest with independents because their operating costs tend to be higher and must be covered. Struggling offices most likely will not survive.

References

-

Sanford C. Bernstein & Co. The long view: the future of the U.S. hearing aid market. Who gains, who loses, from the slow death of independents. June 8, 2015.

-

Hearing aid sales up 11% in first quarter 2015. Hearing Review. April 15, 2015.

Original citation for this article: Staab WJ. The independent hearing aid dispenser. Hearing Review. 2015;22(9):10.

Actually, a few years ago the VA began offering FREE hearing aids to ANYONE who was in the military, whether your loss was service related or not. It used to be it had to be connected to your service. Not now. The beds are also being filled by pencil pushers and other bureaucrats, making it difficult for returning wounded soldiers. Is this a great country or what? Oh, and these are the same people who complain about Obama Care being socialism. LOL

Interesting article, Wayne. Just a comment about VA sales. Remember that these figures probably include the Department of Defense (DoD) as well as the Public Health Service for the Bureau of Indian Affairs. Also, just a minor correction – VA changed its name to Veterans Affairs in 1989. Veterans Health Administration (VHA) is that part of VA that purchases hearing aids to eligible veterans. Thanks.

We, as taxpayers are all getting hosed by the VA and the American Vets that abuse the system…I hear people actually brag that they got their HA from someone that went to the VA and gave them their hearings aids for free…and let’s not forget all the spouse that take advantage of the free batteries…the VA needs to get a handle on this immediately.