Staff Standpoint | February 2016 Hearing Review

According to statistics generated by the Hearing Industries Association (HIA), Washington, DC, hearing aid net sales in the United States grew to 3.36 million units in 2015, a 7.2% increase over the 3.13 million units dispensed in 2014 (Figure 1). For the first time since 2006, the percentage growth in the private sector exceeded that of the Department of Veterans Affairs (VA). Private sector unit sales in 2015 grew by 7.8%, totaling 2.65 million units, compared to 4.8% (710,223 units, or 21.15% of the total US market) for the VA.

Figure 1. US quarterly net unit sales of hearing aids since 2007, with the private/commercial market shown in blue, and the VA shown in red. Yearly sales percentage gains/losses for the entire hearing aid market are displayed at the top of the graph, with VA and private/commercial unit percentage gains shown in the middle and bottom, respectively. Source: HIA.

The fourth quarter (Q4) of 2015 marked strong growth for the private-sector, with an 8.2% increase in sales compared to Q4 2014. The VA increased its dispensing activity by 2.3%. Total hearing aid unit sales grew by 7.0% in Q4 2015.

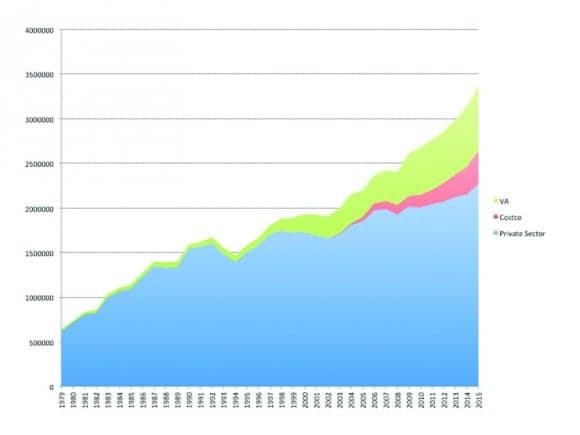

Figure 2. US net unit sales of hearing aids since 1979, with the private market shown in blue, the VA in green, and Hearing Review estimates of Costco sales in red. The VA makes up 21% while HR estimates Costco makes up 11% of the total market in units.

What is not known is how much private sector growth can be attributed to the market gains of low-cost retailers like Costco (Figure 2).

The Hearing Review estimates Costco’s US market share at around 11%, perhaps higher, with annual unit growth at an estimated 20-25% pace during the past 5-7 years. It appears that Sam’s Club, Walmart, and other mass retailers are also experiencing market growth.

Behind-the-ear (BTE) hearing aids continue to dominate industry sales, constituting 78.7% of the total market, and 79.7% of private-sector sales. As a sub-class of BTEs, receiver-in-the-canal (RIC) and receiver in the ear (RITE) devices accounted for 63.7% of the total hearing aid market. By comparison, in 2014, RIC/RITE aids made up 58.0% of the market. Similarly, hearing aids featuring wireless technology continue to grow in popularity. In 2015, the use of wireless hearing aids increased to 87.5% from 82.0% in 2014.

As detailed extensively in our online news and in past issues, PCAST has made recommendations for a new class of over-the-counter/direct-to-consumer hearing aids, and the US Food and Drug Administration (FDA) has just announced the reopening of its comment period regarding the agency’s 2013 Draft Guidance document on personal sound amplification products (PSAPs).

In the February 2016 issue of The Hearing Review, David Smriga points out several errors in the PCAST’s conclusions; Luis Godinho showed in the January 2016 issue that free hearing aids in some European countries didn’t solve the problem of low rates of hearing aid usage.

The re-examination of a heretofore unenforced regulation like the FDA’s Draft Guidance on PSAPs, continued introduction and encouragement of lower-priced hearing aids, and perhaps even a limited OTC/DTC hearing aid class may ultimately prove to be good things for consumers. However, it should also be pointed out that Figures 1 and 2 don’t portray an industry that is stagnant or broken. Adam Smith’s “invisible hand” is already yielding positive pressure in terms of affordability and accessibility—and challenging economic weight on independent practices. If the FDA does decide to make regulatory changes, it must act carefully and not apply pressure that would ultimately crush professional hearing care.